ANNEX I

Milbank LLP

2029 Century Park East, 33rd Floor

Los Aneles, CA 90067

February 5, 2021

VIA EDGAR

Jonathan Burr, Attorney-Advisor

Division of Corporate Finance

Office of Real Estate & Construction

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| Re: | Copper Property CTL Pass Through Trust |

Form 10-12G

Filed December 29, 2020

File No. 000-56236

Dear Mr. Burr:

On behalf of Copper Property CTL Pass Through Trust (the “Trust”), a New York common law trust, we note the receipt by the Trust of the comment letter, dated as of January 25, 2021 (the “Comment Letter”) from the staff of the Securities and Exchange Commission (the “Staff”) regarding the above-referenced Form 10-12G (the “Registration Statement”). We are submitting Amendment No. 1 to the Registration Statement on Form 10 (the “Amended Registration Statement”) of the Trust concurrently with this response.

The Amended Registration Statement reflects the responses of the Trust to the Staff’s comments in the Comment Letter as well as certain other changes as indicated therein. In particular, the Amended Joint Chapter 11 Plan of Reorganization of J. C. Penney Company, Inc. and its Debtor Affiliates became effective pursuant to its terms on January 30, 2021 (the “Emergence”) at which point J. C. Penney transferred its fee or leasehold interest (as applicable) in certain properties to wholly-owned subsidiaries of the Trust and assigned the Master Leases relating to the Properties to the Trust. The Amended Registration Statement reflects the Emergence.

The discussion below is presented in the order of the numbered comments in the Comment Letter. For your convenience, the Staff’s comments in the Comment Letter are reprinted below in italics. References in the responses to page numbers are to the corresponding pages of the Amended Registration Statement. The Trustee, on behalf of the Trust, has asked us to convey the following as its responses to the Staff’s comments in the Comment Letter:

Registration Statement on Form 10-12G filed on December 29, 2020

General

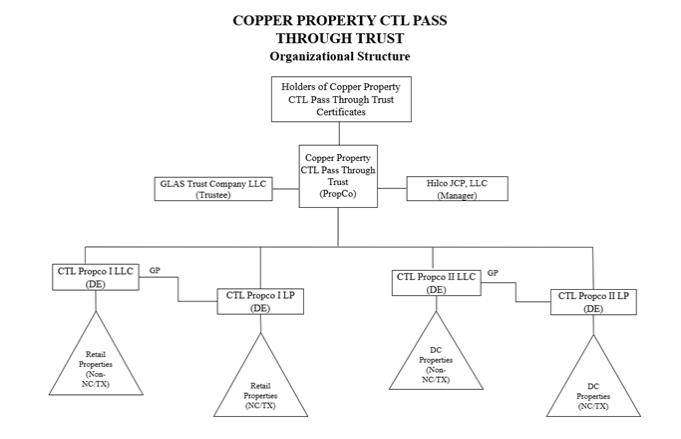

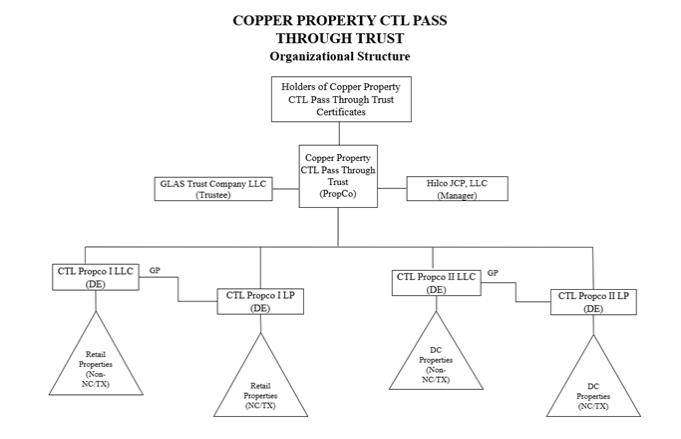

| 1. | Please provide an organizational chart or other visual representation of your structure assuming that the PropCo Formation Transactions have occurred. |

Response to Comment 1

In response to the Staff’s comment, the Trust has included an organization chart reflecting the consummation of the PropCo Formation Transactions, which occurred on January 30, 2021. Please see page 3 of the Amended Registration Statement under the heading “Item 1. Business–Description of the Trust and the Trustee”. A copy of the organization chart is attached hereto as Annex I.

Item 3. Properties, page 27

| 2. | We note your disclosure elsewhere that the retail master lease is subject to a 50% rent abatement for the first year. By footnote, please also present the total annual rent net of abatement and any other tenant concessions or advise. |

Response to Comment 2

The Registration Statement has been revised in response to the Staff’s comment to include this disclosure. The base rent for the Retail Properties from the commencement of the Retail Master Lease through December 31, 2021 is $129.5 million, 50% of which ($64.8 million) is subject to a rental abatement. The first year rent abatement is the only material concession provided to the Tenant. Please see page 27 of the Amended Registration Statement under the heading “Item 3. Properties”.

Item 7. Certain Relationships and Related Transactions and Director Independence

Registration Rights Agreement, page 30

| 3. | We note your disclosure that you express no view as to whether a person would be deemed an “underwriter,” but that you do intend to enter into resale registration rights agreements with certain holders who may not be able to freely transfer their securities. Please clarify if you have identified certificate holders who will require resale registration for their certificates |

Response to Comment 3

The Registration Statement has been revised in response to the Staff’s comment. The Trust has advised us that the Registration Rights Agreement allows certificateholders with more than 9 percent of the outstanding Trust Certificates to require registration of their Trust Certificates and certificateholders with more than 0.5 percent of the outstanding Trust Certificates to elect to participate in any such registration, in each case, without regard to whether or not such Certificateholders’ Trust Certificates were otherwise freely tradeable. The Trust has advised us that it has not identified any Certificateholder who would require resale registration for their Certificates at this time. In addition, whether or not any particular person would be deemed an “underwriter”, for purposes of Section 1145(b) of the Bankruptcy Code, with respect to the Trust Certificates received pursuant to the Plan of Reorganization would depend upon various facts and circumstances applicable to that person. Accordingly, we express no view as to whether any particular person that will receive the Trust Certificates pursuant to the Plan of Reorganization will be deemed an “underwriter” with respect to such Trust Certificates. Please see page 30 of the Amended Registration Statement under the heading “Item 7. Certain Relationships and Related Transactions and Director Independence–Registration Rights Agreement” and page 30 of the Amended Registration Statement under the heading “Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters–Trust Certificates Eligible for Future Sale”.

* * *

Conclusion

We thank the Staff for its attention to the Trust’s submission and we look forward to hearing from you regarding the Amended Registration Statement. If I can be of any assistance during the staff’s review of the enclosed draft Amended Registration Statement, please contact me, collect, by telephone at (424) 386-4380 or by e-mail at cfleck@milbank.com.

| Very truly yours, |

| /s/ Casey T. Fleck, Esq. |

| Cc: | Mr. Neil Aaronson, Copper Property CTL Pass Through Trust. |

Mr. Larry Finger, Copper Property CTL Pass Through Trust.

ANNEX I