PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) July 29, 2023 and July 30, 2022 1

Penney Intermediate Holdings LLC Narrative Report The following discussion, which presents results for the second quarter, should be read in conjunction with the accompanying Consolidated Financial Statements and notes thereto. Unless otherwise indicated, all references in Narrative are as of the date presented and the Company does not undertake any obligation to update these numbers, or to revise or update any statement being made related thereto. Second Quarter Update Throughout the second quarter of Fiscal 2023, JCPenney maintained its commitment to serving working families across America and continuing its transformational efforts. Recently, the Company introduced its reinvigorated brand proposition, ‘Make It Count’ – to help customers make the most of life’s moments. The brand proposition is rooted in four core pillars of the business and customer commitments which include: making fashion truly accessible, providing a genuinely rewarding shopping experience at JCPenney, standing with the Company’s communities, and acting on the Company’s core value of treating others as you would want to be treated. During the second quarter, net sales declined as the macroeconomic environment continued to put pressure on consumer discretionary spending. Although total sales remain down in comparison to last year, second quarter digital sales as a percent of total sales increased over prior year as enhancements to the website continued to resonate with customers. Additionally, the frequency of customer visits to stores increased over the same period last year by 350 bps. Credit income declined slightly reflecting the continued health of the underlying customer portfolio and approval rates for new customers remained strong throughout the quarter. Merchandise gross profit rates improved 70 basis points for the quarter over last year with margin expansion coming from both channels. Notable category margin improvements were seen in the areas of Kids and Home. Customers continued to shift more of their purchases to the Company’s private-label brands like St. John’s Bay and Stafford, further emphasizing the option of quality at a great value that these brands provide. National brands continue to be an important part of the business and performed well in the period with additional brand introductions planned for later this year. Disciplined promotional and clearance activities coupled with a tight inventory management strategy continued to benefit the bottom-line and improve the inventory position for the Company. Overall inventory was down 14% over the same period last year. Due in part to increased investments in infrastructure and growth-minded activities, selling, general, and administrative costs increased slightly over prior year. To offset these planned investments, the Company remains committed to driving greater efficiencies and reducing discretionary spend. Restructuring charges in the period were primarily one-time, non-cash charges related to the transition of JCP Beauty that were offset by one-time gains recorded during the period. As a result of margin improvement efforts and continued expense discipline, the Company recorded net income of $36M during the period. In the second quarter, the Company generated operating cash flow as measured by Adjusted EBITDA of $92M, enabling continued self-funding of capital investments. Capital investments during the period totaled $76M, furthering the efforts to transform our store and omni-channel experience for customers. In early September, the Company announced a commitment to reinvest $1 billion in the business by Fiscal Year 2025. The investments are focused on strengthening the customer experience through enhanced digital capabilities, in-store physical and technology upgrades, and optimizing merchandising and supply chain. This reinvestment will build on key areas of transformation already completed. The Company continues to prioritize maintaining a very healthy balance sheet with significant liquidity. As of the end of the second quarter the Company had over $1.7B liquidity, long-term debt of less than $500M, and one of the lowest debt leverage ratios in the retail industry.

PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) July 29, 2023 and July 30, 2022 Table of Contents Page Consolidated Statements of Comprehensive Income 3 Consolidated Balance Sheets 5 Consolidated Statements of Member’s Equity 6 Consolidated Statements of Cash Flows 7 Notes to the Consolidated Financial Statements 8 2

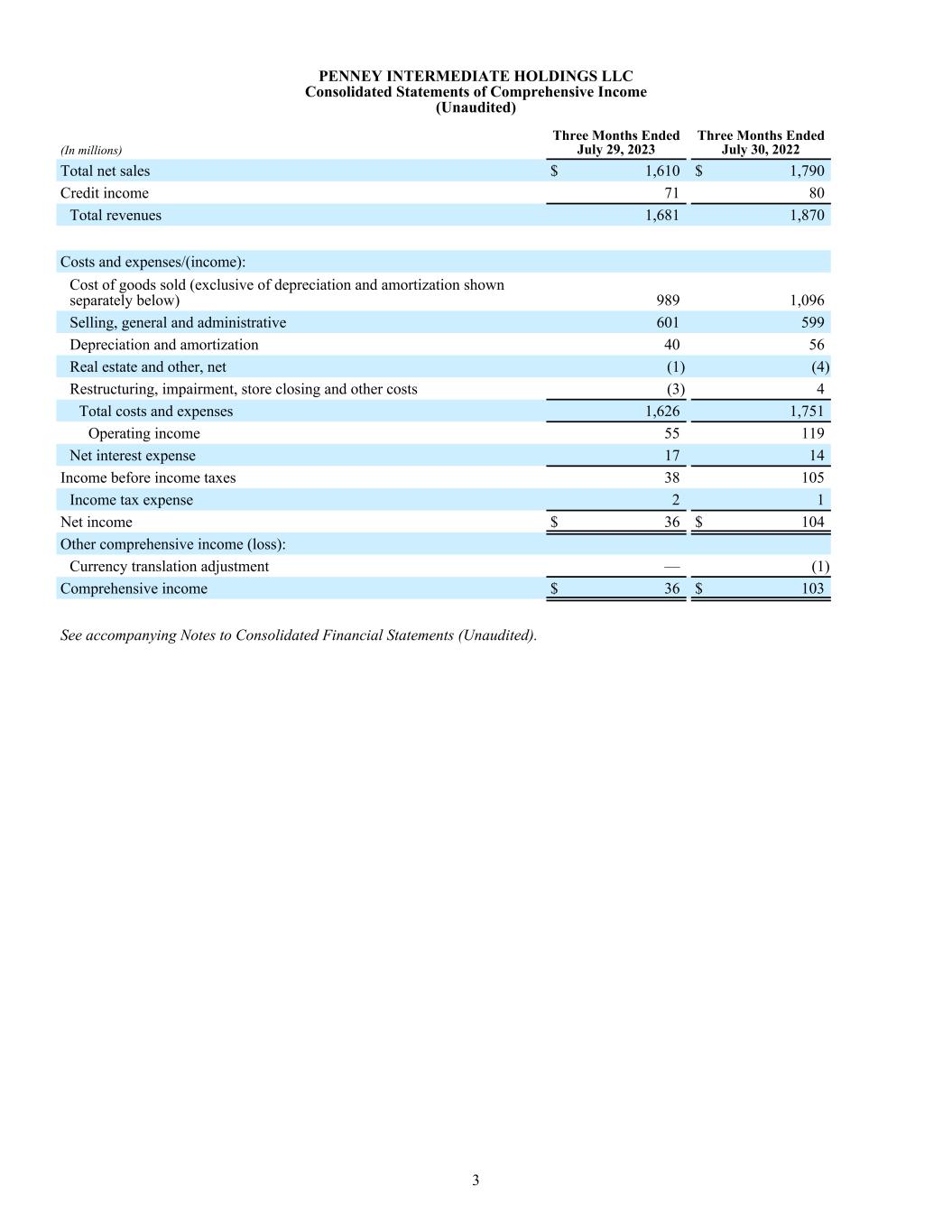

PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Unaudited) (In millions) Three Months Ended July 29, 2023 Three Months Ended July 30, 2022 Total net sales $ 1,610 $ 1,790 Credit income 71 80 Total revenues 1,681 1,870 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 989 1,096 Selling, general and administrative 601 599 Depreciation and amortization 40 56 Real estate and other, net (1) (4) Restructuring, impairment, store closing and other costs (3) 4 Total costs and expenses 1,626 1,751 Operating income 55 119 Net interest expense 17 14 Income before income taxes 38 105 Income tax expense 2 1 Net income $ 36 $ 104 Other comprehensive income (loss): Currency translation adjustment — (1) Comprehensive income $ 36 $ 103 See accompanying Notes to Consolidated Financial Statements (Unaudited). 3

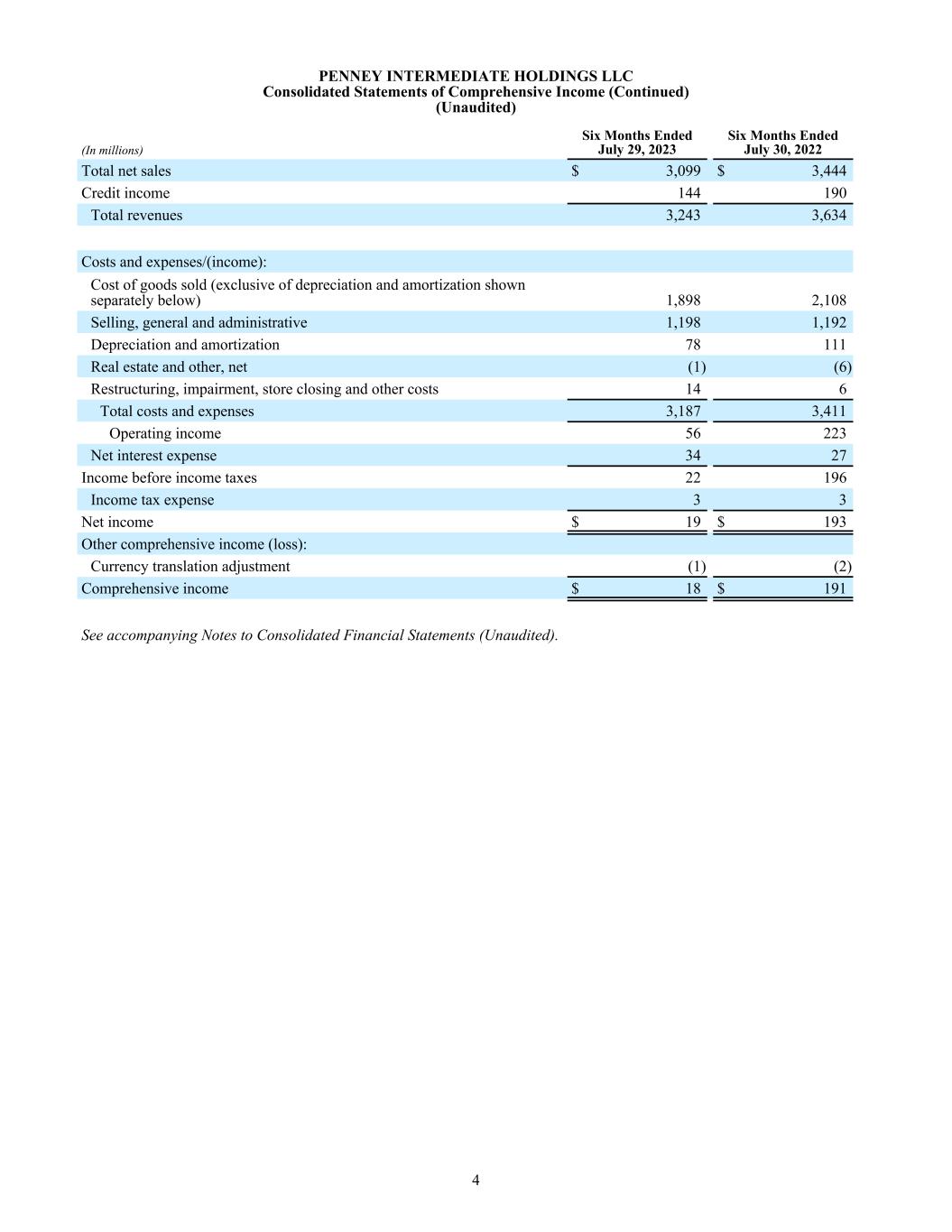

PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Continued) (Unaudited) (In millions) Six Months Ended July 29, 2023 Six Months Ended July 30, 2022 Total net sales $ 3,099 $ 3,444 Credit income 144 190 Total revenues 3,243 3,634 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 1,898 2,108 Selling, general and administrative 1,198 1,192 Depreciation and amortization 78 111 Real estate and other, net (1) (6) Restructuring, impairment, store closing and other costs 14 6 Total costs and expenses 3,187 3,411 Operating income 56 223 Net interest expense 34 27 Income before income taxes 22 196 Income tax expense 3 3 Net income $ 19 $ 193 Other comprehensive income (loss): Currency translation adjustment (1) (2) Comprehensive income $ 18 $ 191 See accompanying Notes to Consolidated Financial Statements (Unaudited). 4

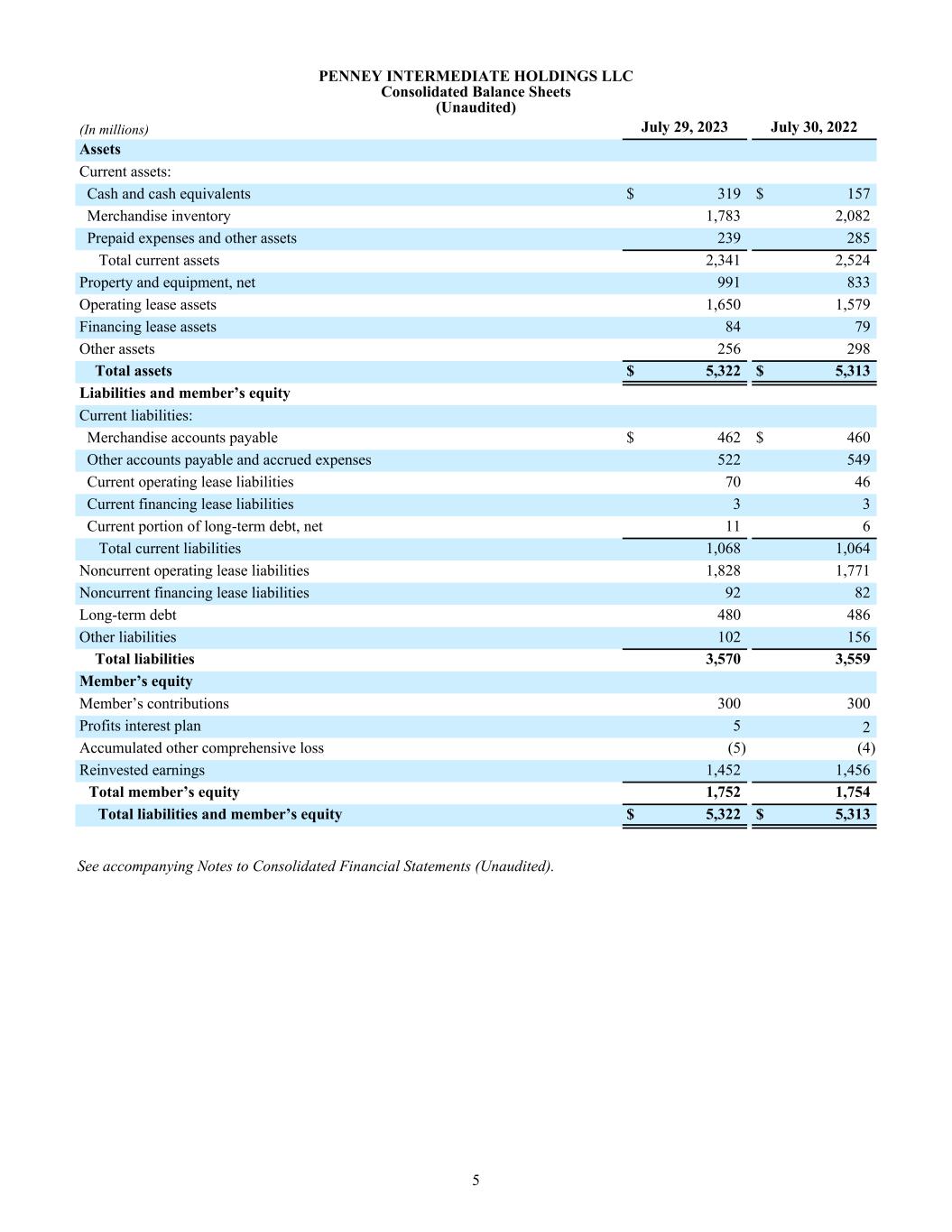

PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Balance Sheets (Unaudited) (In millions) July 29, 2023 July 30, 2022 Assets Current assets: Cash and cash equivalents $ 319 $ 157 Merchandise inventory 1,783 2,082 Prepaid expenses and other assets 239 285 Total current assets 2,341 2,524 Property and equipment, net 991 833 Operating lease assets 1,650 1,579 Financing lease assets 84 79 Other assets 256 298 Total assets $ 5,322 $ 5,313 Liabilities and member’s equity Current liabilities: Merchandise accounts payable $ 462 $ 460 Other accounts payable and accrued expenses 522 549 Current operating lease liabilities 70 46 Current financing lease liabilities 3 3 Current portion of long-term debt, net 11 6 Total current liabilities 1,068 1,064 Noncurrent operating lease liabilities 1,828 1,771 Noncurrent financing lease liabilities 92 82 Long-term debt 480 486 Other liabilities 102 156 Total liabilities 3,570 3,559 Member’s equity Member’s contributions 300 300 Profits interest plan 5 2 Accumulated other comprehensive loss (5) (4) Reinvested earnings 1,452 1,456 Total member’s equity 1,752 1,754 Total liabilities and member’s equity $ 5,322 $ 5,313 See accompanying Notes to Consolidated Financial Statements (Unaudited). 5

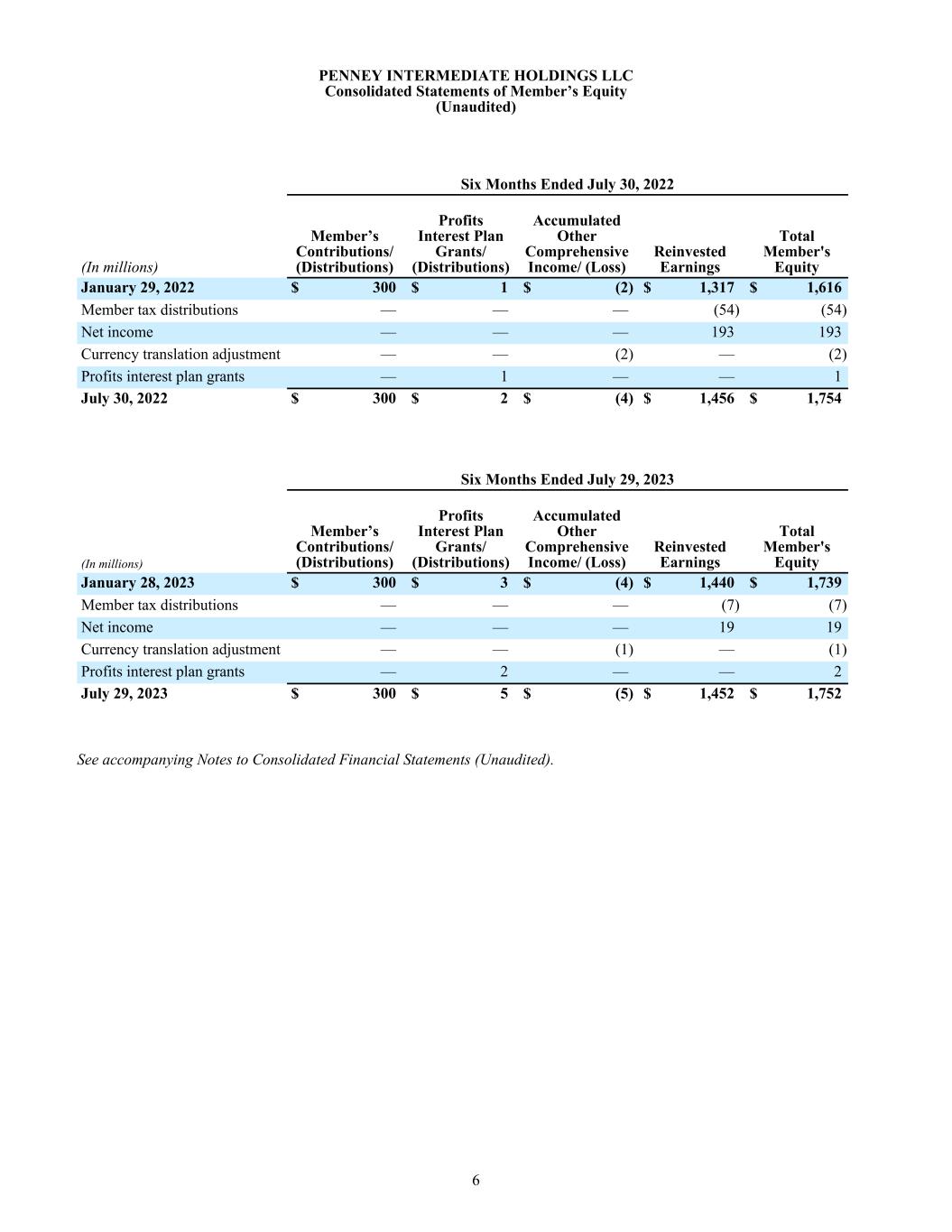

PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Member’s Equity (Unaudited) Six Months Ended July 30, 2022 (In millions) Member’s Contributions/ (Distributions) Profits Interest Plan Grants/ (Distributions) Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity January 29, 2022 $ 300 $ 1 $ (2) $ 1,317 $ 1,616 Member tax distributions — — — (54) (54) Net income — — — 193 193 Currency translation adjustment — — (2) — (2) Profits interest plan grants — 1 — — 1 July 30, 2022 $ 300 $ 2 $ (4) $ 1,456 $ 1,754 Six Months Ended July 29, 2023 (In millions) Member’s Contributions/ (Distributions) Profits Interest Plan Grants/ (Distributions) Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity January 28, 2023 $ 300 $ 3 $ (4) $ 1,440 $ 1,739 Member tax distributions — — — (7) (7) Net income — — — 19 19 Currency translation adjustment — — (1) — (1) Profits interest plan grants — 2 — — 2 July 29, 2023 $ 300 $ 5 $ (5) $ 1,452 $ 1,752 See accompanying Notes to Consolidated Financial Statements (Unaudited). 6

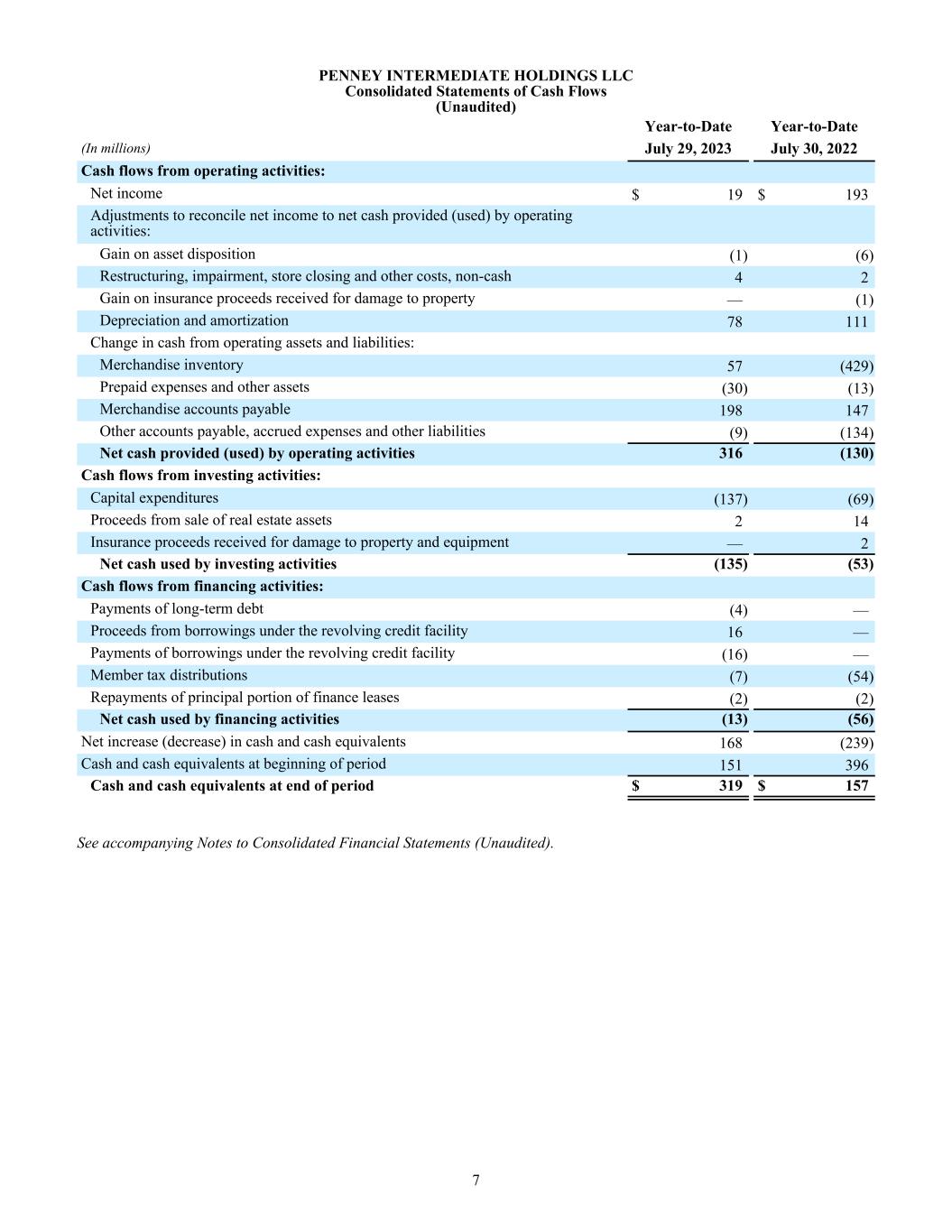

PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Cash Flows (Unaudited) Year-to-Date Year-to-Date (In millions) July 29, 2023 July 30, 2022 Cash flows from operating activities: Net income $ 19 $ 193 Adjustments to reconcile net income to net cash provided (used) by operating activities: Gain on asset disposition (1) (6) Restructuring, impairment, store closing and other costs, non-cash 4 2 Gain on insurance proceeds received for damage to property — (1) Depreciation and amortization 78 111 Change in cash from operating assets and liabilities: Merchandise inventory 57 (429) Prepaid expenses and other assets (30) (13) Merchandise accounts payable 198 147 Other accounts payable, accrued expenses and other liabilities (9) (134) Net cash provided (used) by operating activities 316 (130) Cash flows from investing activities: Capital expenditures (137) (69) Proceeds from sale of real estate assets 2 14 Insurance proceeds received for damage to property and equipment — 2 Net cash used by investing activities (135) (53) Cash flows from financing activities: Payments of long-term debt (4) — Proceeds from borrowings under the revolving credit facility 16 — Payments of borrowings under the revolving credit facility (16) — Member tax distributions (7) (54) Repayments of principal portion of finance leases (2) (2) Net cash used by financing activities (13) (56) Net increase (decrease) in cash and cash equivalents 168 (239) Cash and cash equivalents at beginning of period 151 396 Cash and cash equivalents at end of period $ 319 $ 157 See accompanying Notes to Consolidated Financial Statements (Unaudited). 7

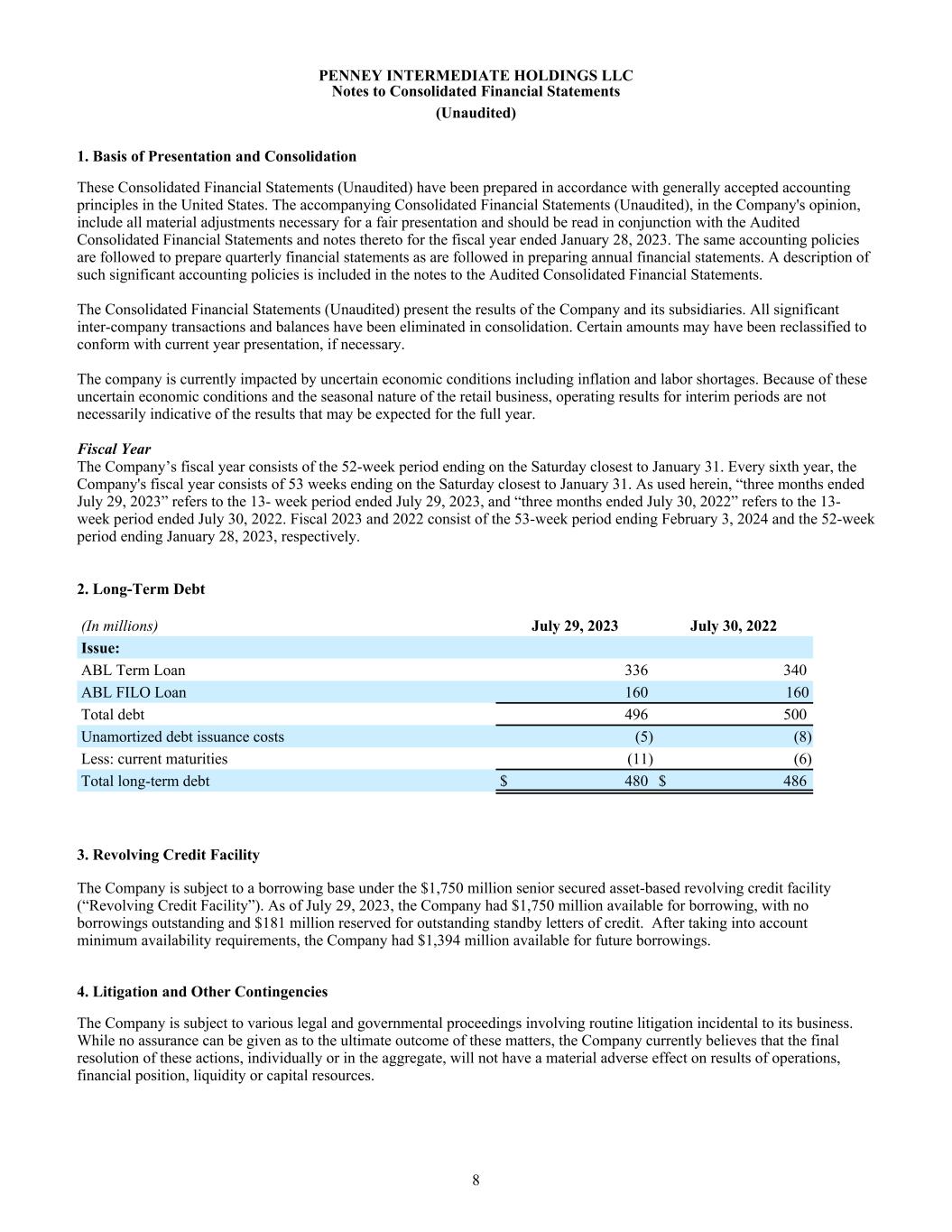

PENNEY INTERMEDIATE HOLDINGS LLC Notes to Consolidated Financial Statements (Unaudited) 1. Basis of Presentation and Consolidation These Consolidated Financial Statements (Unaudited) have been prepared in accordance with generally accepted accounting principles in the United States. The accompanying Consolidated Financial Statements (Unaudited), in the Company's opinion, include all material adjustments necessary for a fair presentation and should be read in conjunction with the Audited Consolidated Financial Statements and notes thereto for the fiscal year ended January 28, 2023. The same accounting policies are followed to prepare quarterly financial statements as are followed in preparing annual financial statements. A description of such significant accounting policies is included in the notes to the Audited Consolidated Financial Statements. The Consolidated Financial Statements (Unaudited) present the results of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation. Certain amounts may have been reclassified to conform with current year presentation, if necessary. The company is currently impacted by uncertain economic conditions including inflation and labor shortages. Because of these uncertain economic conditions and the seasonal nature of the retail business, operating results for interim periods are not necessarily indicative of the results that may be expected for the full year. Fiscal Year The Company’s fiscal year consists of the 52-week period ending on the Saturday closest to January 31. Every sixth year, the Company's fiscal year consists of 53 weeks ending on the Saturday closest to January 31. As used herein, “three months ended July 29, 2023” refers to the 13- week period ended July 29, 2023, and “three months ended July 30, 2022” refers to the 13- week period ended July 30, 2022. Fiscal 2023 and 2022 consist of the 53-week period ending February 3, 2024 and the 52-week period ending January 28, 2023, respectively. 2. Long-Term Debt (In millions) July 29, 2023 July 30, 2022 Issue: ABL Term Loan 336 340 ABL FILO Loan 160 160 Total debt 496 500 Unamortized debt issuance costs (5) (8) Less: current maturities (11) (6) Total long-term debt $ 480 $ 486 3. Revolving Credit Facility The Company is subject to a borrowing base under the $1,750 million senior secured asset-based revolving credit facility (“Revolving Credit Facility”). As of July 29, 2023, the Company had $1,750 million available for borrowing, with no borrowings outstanding and $181 million reserved for outstanding standby letters of credit. After taking into account minimum availability requirements, the Company had $1,394 million available for future borrowings. 4. Litigation and Other Contingencies The Company is subject to various legal and governmental proceedings involving routine litigation incidental to its business. While no assurance can be given as to the ultimate outcome of these matters, the Company currently believes that the final resolution of these actions, individually or in the aggregate, will not have a material adverse effect on results of operations, financial position, liquidity or capital resources. 8

5. Subsequent Events The Company has evaluated subsequent events from the balance sheet date through September 12, 2023, the date at which the financial statements were available to be issued. 9

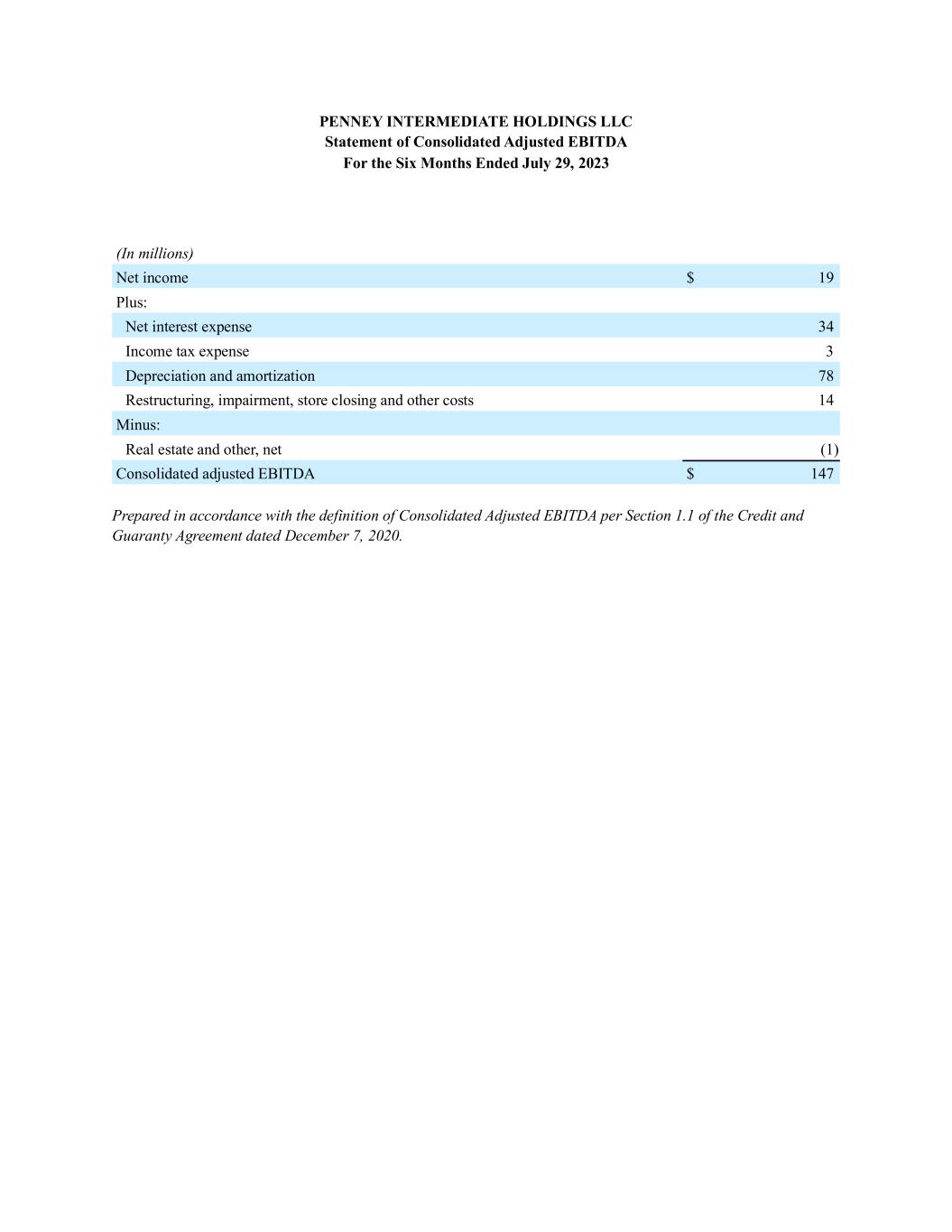

STATEMENT OF CONSOLIDATED ADJUSTED EBITDA (follows this page)

PENNEY INTERMEDIATE HOLDINGS LLC Statement of Consolidated Adjusted EBITDA For the Six Months Ended July 29, 2023 (In millions) Net income $ 19 Plus: Net interest expense 34 Income tax expense 3 Depreciation and amortization 78 Restructuring, impairment, store closing and other costs 14 Minus: Real estate and other, net (1) Consolidated adjusted EBITDA $ 147 Prepared in accordance with the definition of Consolidated Adjusted EBITDA per Section 1.1 of the Credit and Guaranty Agreement dated December 7, 2020.

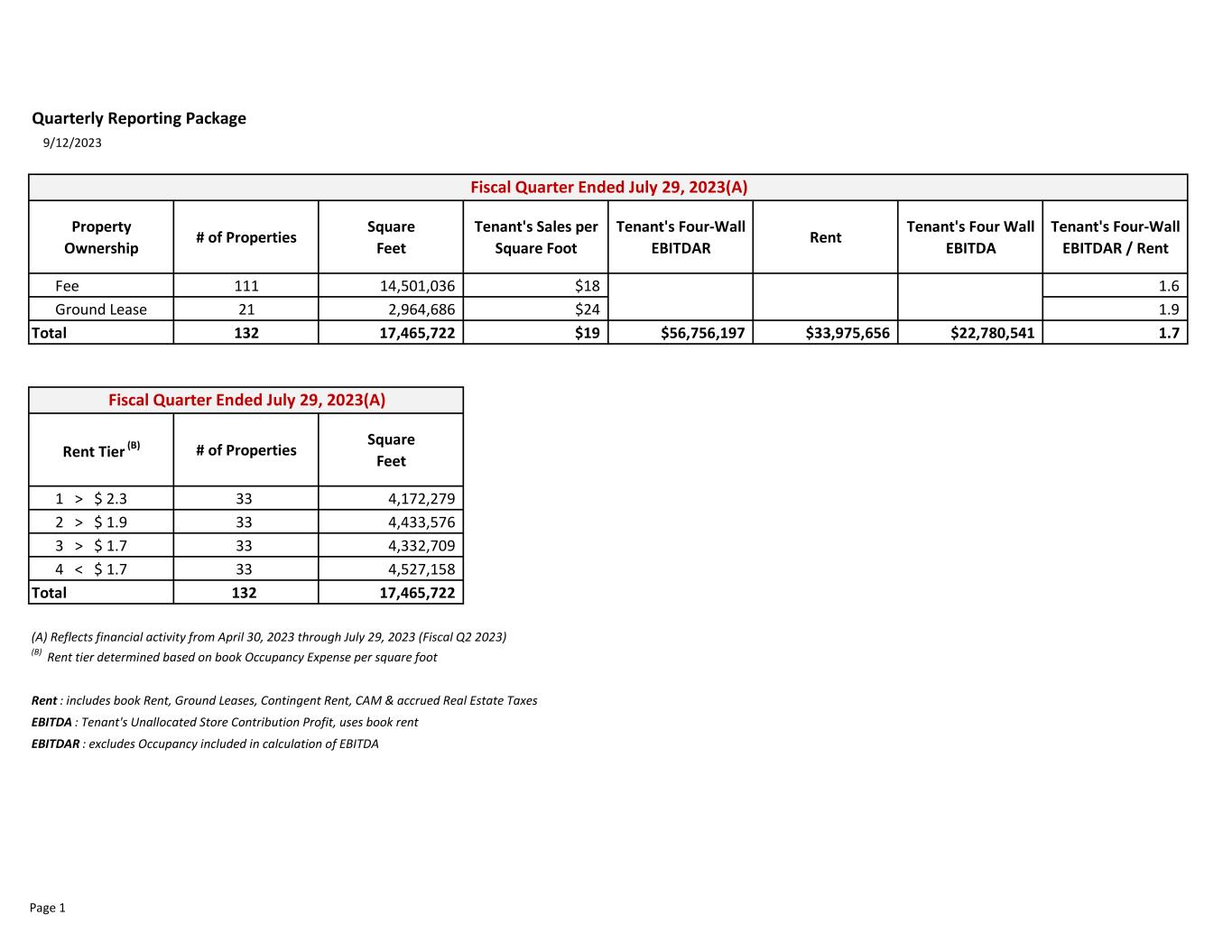

STORE REPORTING PACKAGE (follows this page)

Quarterly Reporting Package 9/12/2023 Property Ownership # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent Fee 111 14,501,036 $18 $43,500,207 $26,904,875 $16,595,332 1.6 Ground Lease 21 2,964,686 $24 $13,255,990 $7,070,781 $6,185,209 1.9 Total 132 17,465,722 $19 $56,756,197 $33,975,656 $22,780,541 1.7 Rent Tier (B) # of Properties Square Feet 1 > $ 2.3 33 4,172,279 2 > $ 1.9 33 4,433,576 3 > $ 1.7 33 4,332,709 4 < $ 1.7 33 4,527,158 Total 132 17,465,722 (A) Reflects financial activity from April 30, 2023 through July 29, 2023 (Fiscal Q2 2023) (B) Rent tier determined based on book Occupancy Expense per square foot Rent : includes book Rent, Ground Leases, Contingent Rent, CAM & accrued Real Estate Taxes EBITDA : Tenant's Unallocated Store Contribution Profit, uses book rent EBITDAR : excludes Occupancy included in calculation of EBITDA Fiscal Quarter Ended July 29, 2023(A) Fiscal Quarter Ended July 29, 2023(A) Page 1

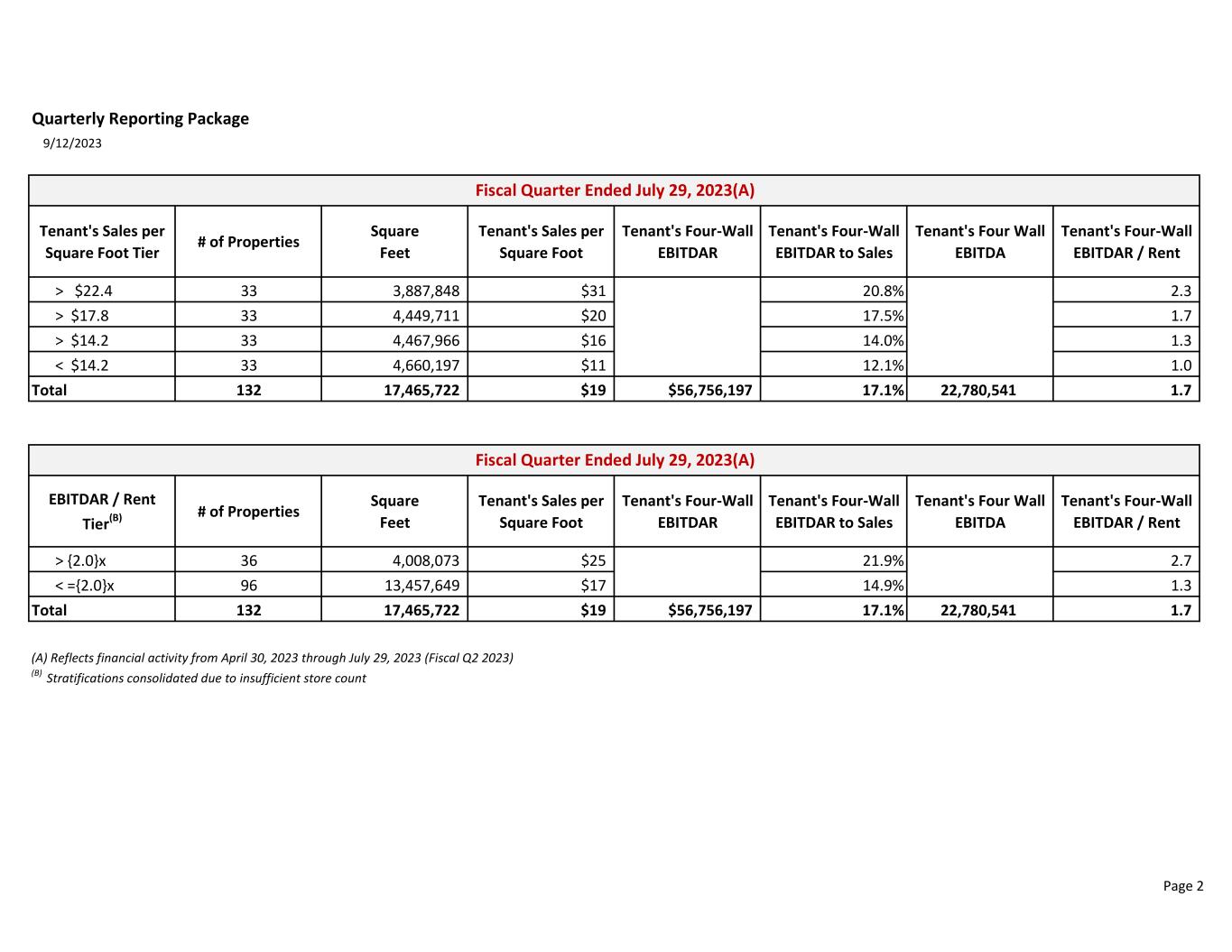

Quarterly Reporting Package 9/12/2023 Tenant's Sales per Square Foot Tier # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > $22.4 33 3,887,848 $31 20.8% 2.3 > $17.8 33 4,449,711 $20 17.5% 1.7 > $14.2 33 4,467,966 $16 14.0% 1.3 < $14.2 33 4,660,197 $11 12.1% 1.0 Total 132 17,465,722 $19 $56,756,197 17.1% 22,780,541 1.7 EBITDAR / Rent Tier(B) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > {2.0}x 36 4,008,073 $25 21.9% 2.7 < ={2.0}x 96 13,457,649 $17 14.9% 1.3 Total 132 17,465,722 $19 $56,756,197 17.1% 22,780,541 1.7 (A) Reflects financial activity from April 30, 2023 through July 29, 2023 (Fiscal Q2 2023) (B) Stratifications consolidated due to insufficient store count Fiscal Quarter Ended July 29, 2023(A) Fiscal Quarter Ended July 29, 2023(A) Page 2

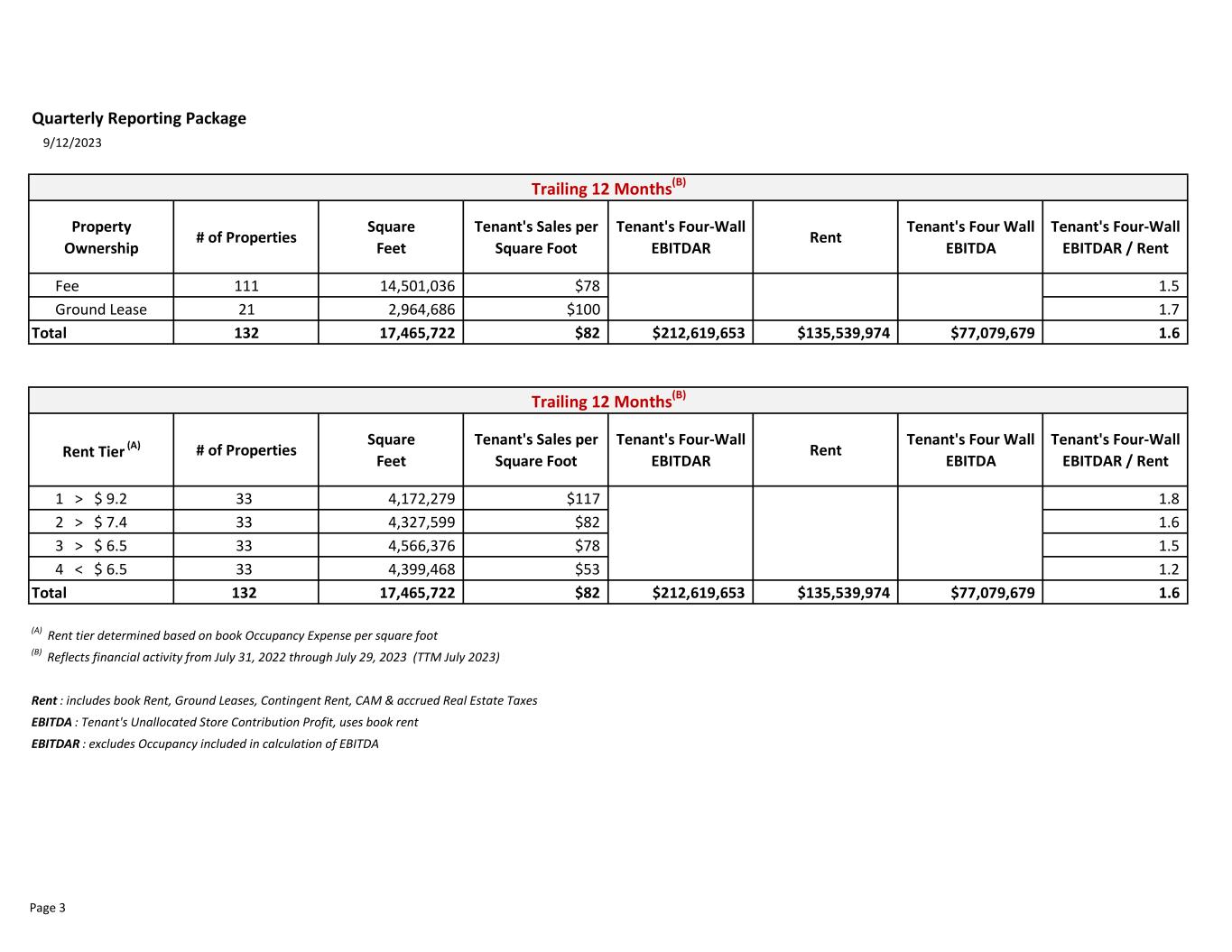

Quarterly Reporting Package 9/12/2023 Property Ownership # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent Fee 111 14,501,036 $78 $163,720,531 $107,033,404 $56,687,127 1.5 Ground Lease 21 2,964,686 $100 $48,899,122 $28,506,570 $20,392,552 1.7 Total 132 17,465,722 $82 $212,619,653 $135,539,974 $77,079,679 1.6 Rent Tier (A) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent 1 > $ 9.2 33 4,172,279 $117 $84,298,644 $47,391,754 1.8 2 > $ 7.4 33 4,327,599 $82 $56,470,844 $35,815,866 1.6 3 > $ 6.5 33 4,566,376 $78 $46,902,197 $31,924,554 1.5 4 < $ 6.5 33 4,399,468 $53 $24,947,968 $20,407,801 1.2 Total 132 17,465,722 $82 $212,619,653 $135,539,974 $77,079,679 1.6 (A) Rent tier determined based on book Occupancy Expense per square foot (B) Reflects financial activity from July 31, 2022 through July 29, 2023 (TTM July 2023) Rent : includes book Rent, Ground Leases, Contingent Rent, CAM & accrued Real Estate Taxes EBITDA : Tenant's Unallocated Store Contribution Profit, uses book rent EBITDAR : excludes Occupancy included in calculation of EBITDA Trailing 12 Months(B) Trailing 12 Months(B) Page 3

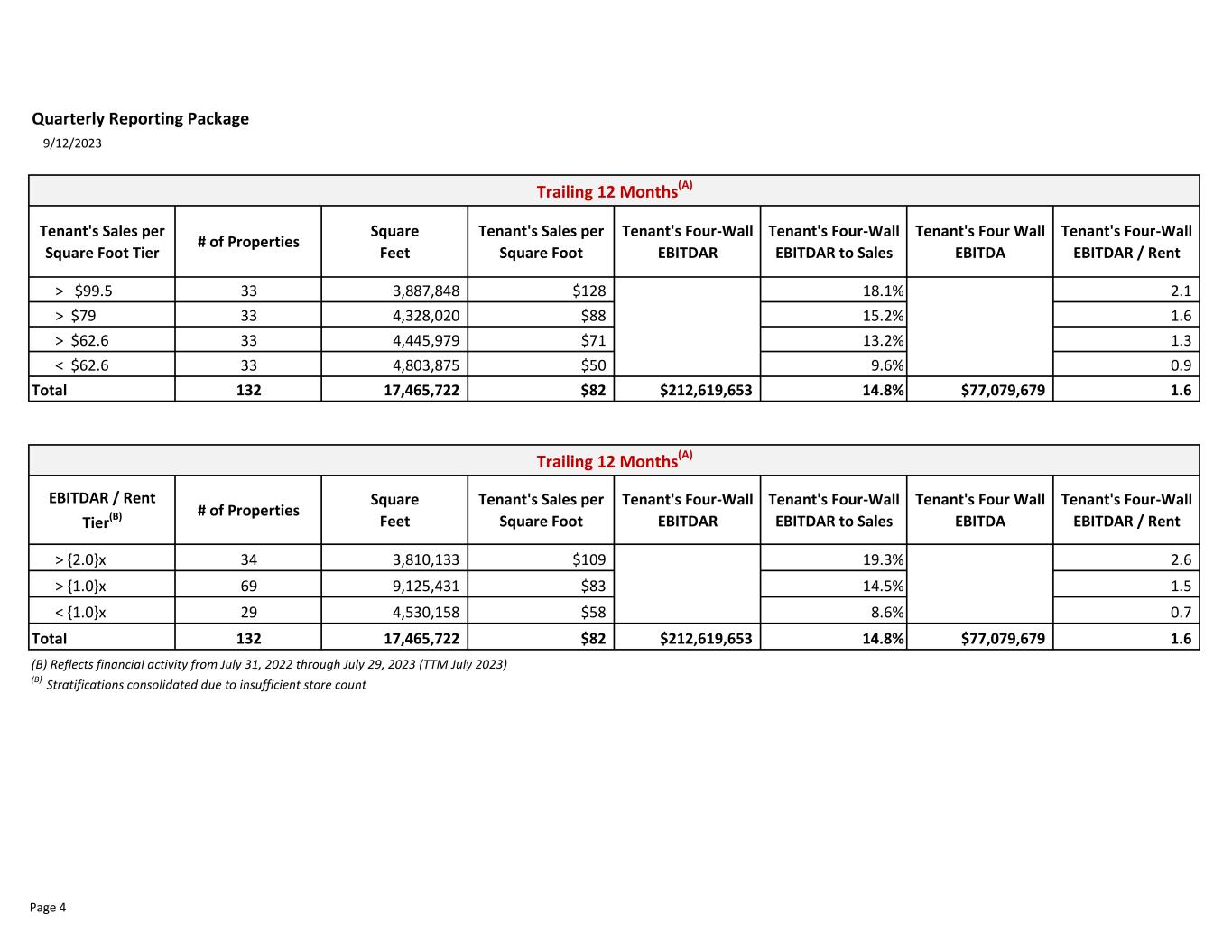

Quarterly Reporting Package 9/12/2023 Tenant's Sales per Square Foot Tier # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > $99.5 33 3,887,848 $128 18.1% 2.1 > $79 33 4,328,020 $88 15.2% 1.6 > $62.6 33 4,445,979 $71 13.2% 1.3 < $62.6 33 4,803,875 $50 9.6% 0.9 Total 132 17,465,722 $82 $212,619,653 14.8% $77,079,679 1.6 EBITDAR / Rent Tier(B) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > {2.0}x 34 3,810,133 $109 19.3% 2.6 > {1.0}x 69 9,125,431 $83 14.5% 1.5 < {1.0}x 29 4,530,158 $58 8.6% 0.7 Total 132 17,465,722 $82 $212,619,653 14.8% $77,079,679 1.6 (B) Reflects financial activity from July 31, 2022 through July 29, 2023 (TTM July 2023) (B) Stratifications consolidated due to insufficient store count Trailing 12 Months(A) Trailing 12 Months(A) Page 4

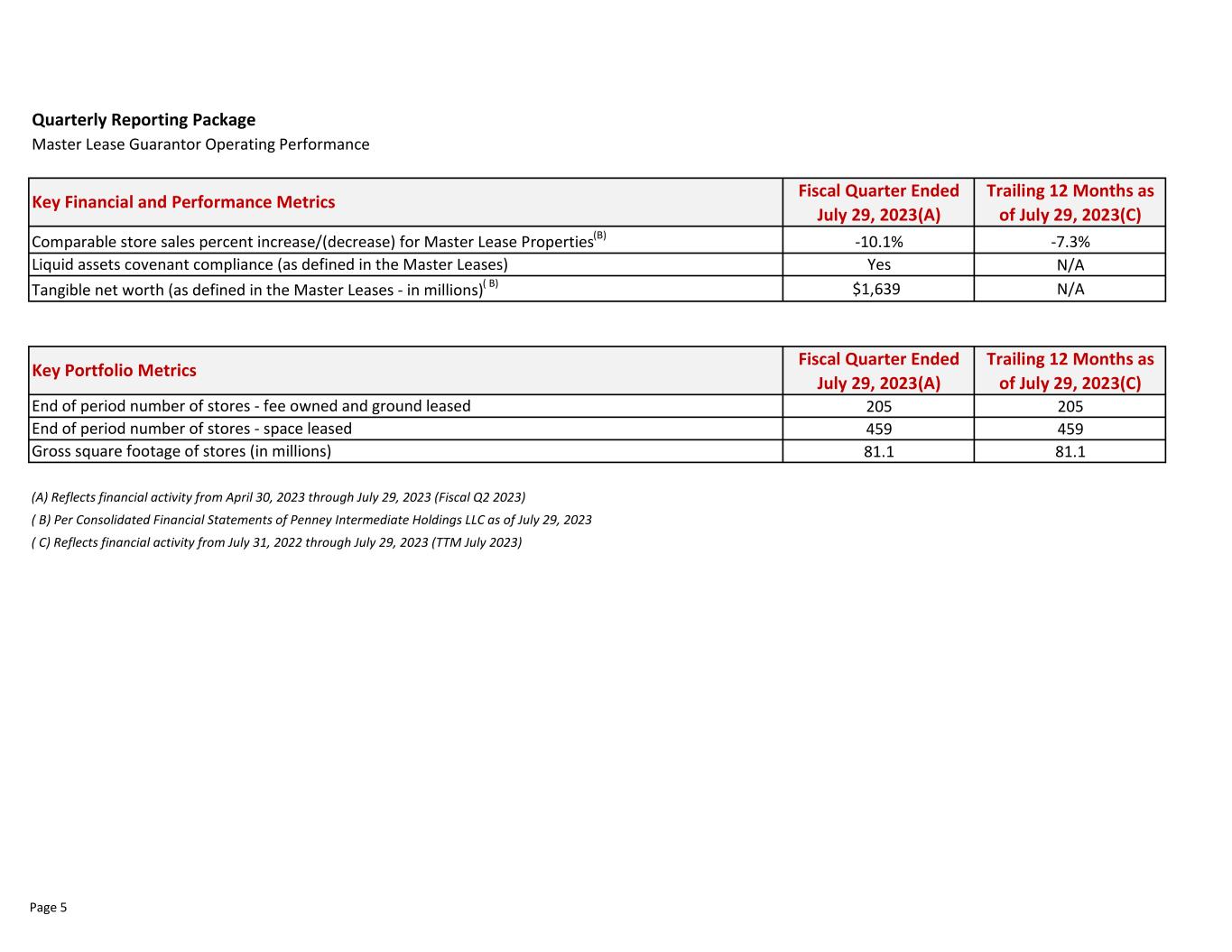

Quarterly Reporting Package Master Lease Guarantor Operating Performance Fiscal Quarter Ended July 29, 2023(A) Trailing 12 Months as of July 29, 2023(C) -10.1% -7.3% Yes N/A $1,639 N/A Fiscal Quarter Ended July 29, 2023(A) Trailing 12 Months as of July 29, 2023(C) 205 205 459 459 81.1 81.1 (A) Reflects financial activity from April 30, 2023 through July 29, 2023 (Fiscal Q2 2023) ( B) Per Consolidated Financial Statements of Penney Intermediate Holdings LLC as of July 29, 2023 ( C) Reflects financial activity from July 31, 2022 through July 29, 2023 (TTM July 2023) End of period number of stores - space leased Gross square footage of stores (in millions) Key Financial and Performance Metrics Comparable store sales percent increase/(decrease) for Master Lease Properties(B) Liquid assets covenant compliance (as defined in the Master Leases) Tangible net worth (as defined in the Master Leases - in millions)( B) Key Portfolio Metrics End of period number of stores - fee owned and ground leased Page 5