1 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) October 28, 2023 and October 29, 2022

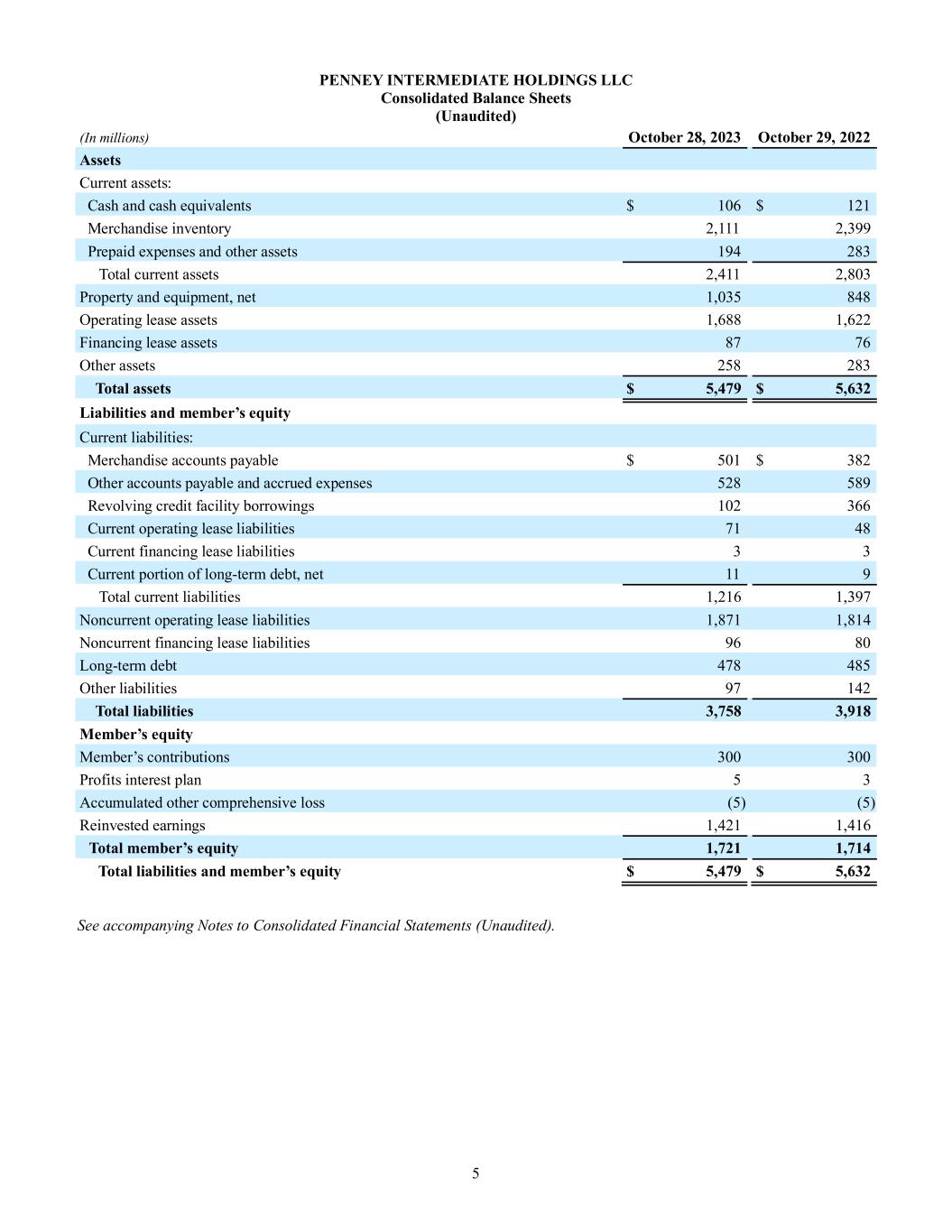

Third Quarter Narrative Report The following discussion, which presents results for the third quarter, should be read in conjunction with the accompanying Consolidated Financial Statements and notes thereto. Unless otherwise indicated, all references in Narrative are as of the date presented and the Company does not undertake any obligation to update these numbers, or to revise or update any statement being made related thereto. Third Quarter Update During the quarter, the Company maintained its commitment to serving working families across America and to its transformation efforts. In early September, the Company formally introduced its ‘Make It Count’ brand proposition, which is a key strategic initiative designed to drive long-term growth and sustainable traffic and build customer loyalty. Customers responded favorably and as a result, customer frequency increased 300 bp in the period while digital sales as a percent of total sales improved 200 bp over last year. In addition to making trips more frequently, customers’ average sales increased 11% in the quarter, a reflection of customers’ confidence in the value and quality of the merchandise the Company offers. Investments in store environment yielded additional positive increases in net promoter scores and improved overall brand awareness. Over the quarter, the overall store traffic trend improved 160 bp. While all these improvements reflect the positive impact of the Company’s transformational investments and efforts, macroeconomic challenges continued during the quarter and led to a decline in sales. During the period, customer engagement continued to expand as the loyalty program saw significant increases in new enrollments and private-label credit card approval rates remained strong. Amid rising interest rates and declining consumer savings, the underlying credit card portfolio remained healthy, but declining late fees, cyclical rising losses and higher program costs reduced the Company share of credit income when compared to last year. Merchandise gross profit rates improved 270 basis points for the quarter over last year with margin expansion coming from both national and private brand merchandise. Notable category margin improvements were seen in the areas of women’s apparel, adult active, and footwear and handbags. Private brands continued to see selling margin improvements in brands like St John’s Bay and Liz Claiborne, while national brand performance benefited from the reintroduction of brands like Adidas, Dickies and Wrangler. Strong performance in fragrances drove momentum increases for JCP Beauty, along with cross-shopping increases from Beauty customers. The exclusive cookware collaboration with celebrity chef Jenny Martinez, Mesa Mia, drove additional customer engagement both in store and online through personal appearances and digital events, which are planned to continue during the holiday season. Along with these important brand initiatives, ongoing discipline in promotional and markdown activities, supported by strategic investments in planning and allocation tools, resulted in bottom line benefits and further improved the inventory position for the Company. Overall inventory was down 12% over the same period last year. Selling, general, and administrative costs increased slightly over prior year as the Company made additional strategic investments in employee wages, infrastructure and growth-minded activities. Strict expense control helped to mitigate the impact of lower sales. The Company generated positive operating cash flow and reported Adjusted EBITDA of $181M for the first nine months of the year. Self-funded capital investments during the period totaled $95M, expanding the efforts to transform the store and omni-channel experience for customers. The Company continues to prioritize maintaining a very healthy balance sheet with significant liquidity. As a result of tight inventory management and improved working capital efficiencies, the Company decreased its required utilization of its working capital line of credit for the seasonal build in inventory. The outstanding balance on the line of credit at the end of the third quarter was $102M compared to $366M last year. The entire amount outstanding was repaid in November and the facility remains undrawn as of the issuance date of this report. At the end of the third quarter, the Company had available liquidity of over $1.5B, long-term debt of less than $500M, and continued to report one of the lowest debt leverage ratios in the retail industry.

2 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) October 28, 2023 and October 29, 2022 Table of Contents Page Consolidated Statements of Comprehensive Income 3 Consolidated Balance Sheets 5 Consolidated Statements of Member’s Equity 6 Consolidated Statements of Cash Flows 7 Notes to the Consolidated Financial Statements 8

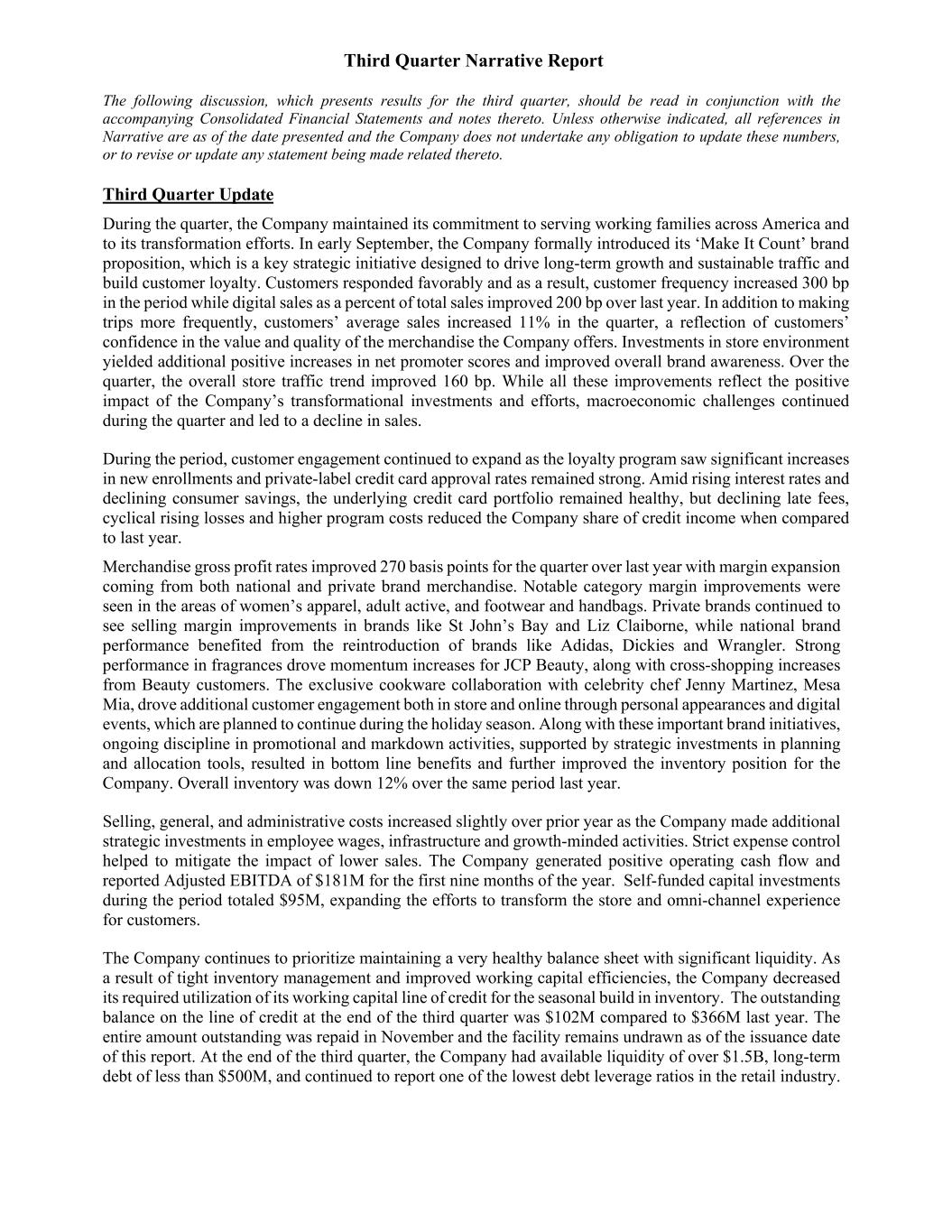

3 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Unaudited) (In millions) Three Months Ended October 28, 2023 Three Months Ended October 29, 2022 Total net sales $ 1,533 $ 1,717 Credit income 70 86 Total revenues 1,603 1,803 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 943 1,103 Selling, general and administrative 626 629 Depreciation and amortization 43 59 Restructuring, impairment, store closing and other costs 1 10 Total costs and expenses 1,613 1,801 Operating income (loss) (10) 2 Net interest expense 18 18 Loss before income taxes (28) (16) Income tax expense 2 1 Net loss $ (30) $ (17) Other comprehensive income (loss): Currency translation adjustment — (1) Comprehensive loss $ (30) $ (18) See accompanying Notes to Consolidated Financial Statements (Unaudited).

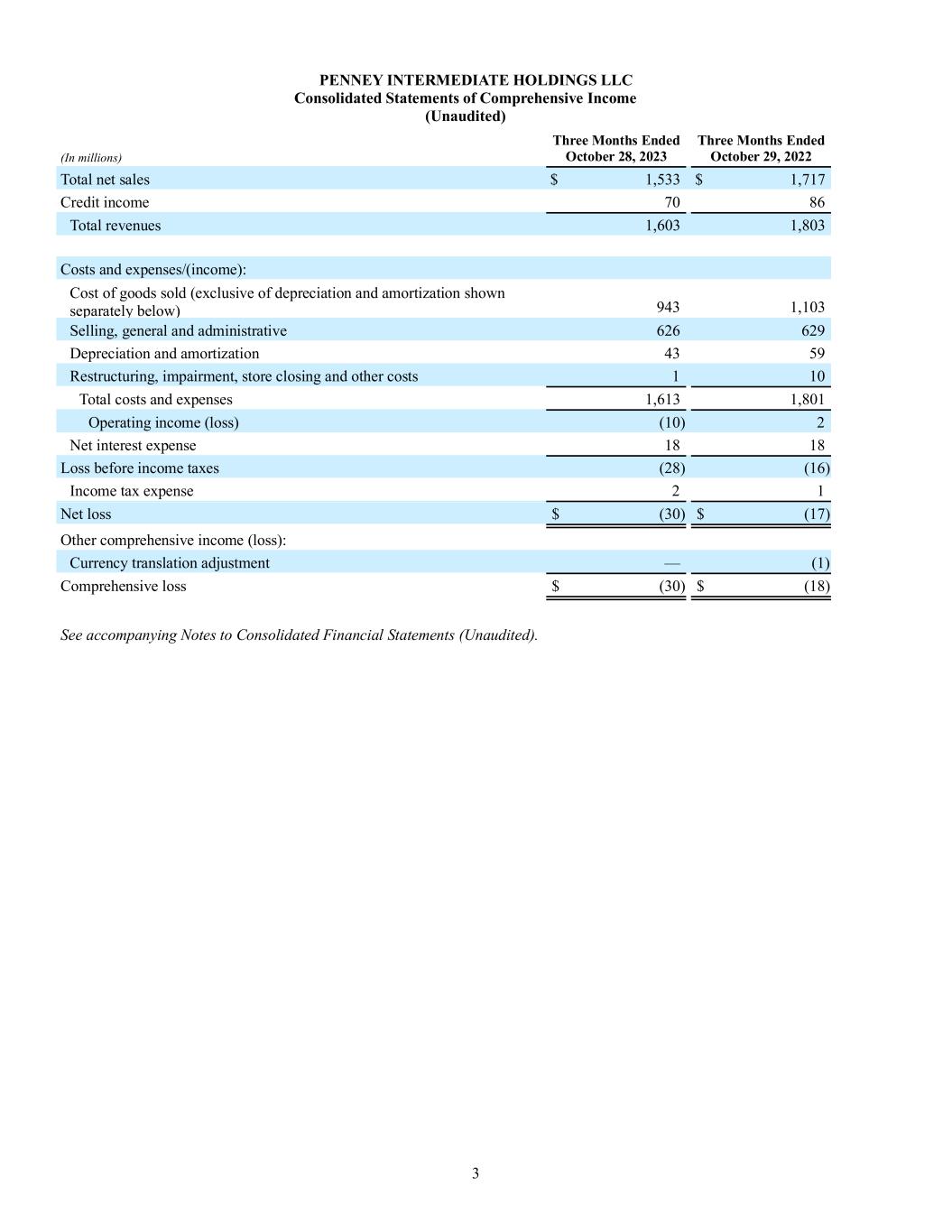

4 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Continued) (Unaudited) (In millions) Nine Months Ended October 28, 2023 Nine Months Ended October 29, 2022 Total net sales $ 4,632 $ 5,161 Credit income 214 276 Total revenues 4,846 5,437 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 2,841 3,211 Selling, general and administrative 1,824 1,821 Depreciation and amortization 121 170 Real estate and other, net (1) (6) Restructuring, impairment, store closing and other costs 15 16 Total costs and expenses 4,800 5,212 Operating income 46 225 Net interest expense 52 45 Income (loss) before income taxes (6) 180 Income tax expense 5 4 Net income (loss) $ (11) $ 176 Other comprehensive income (loss): Currency translation adjustment (1) (3) Comprehensive income (loss) $ (12) $ 173 See accompanying Notes to Consolidated Financial Statements (Unaudited).

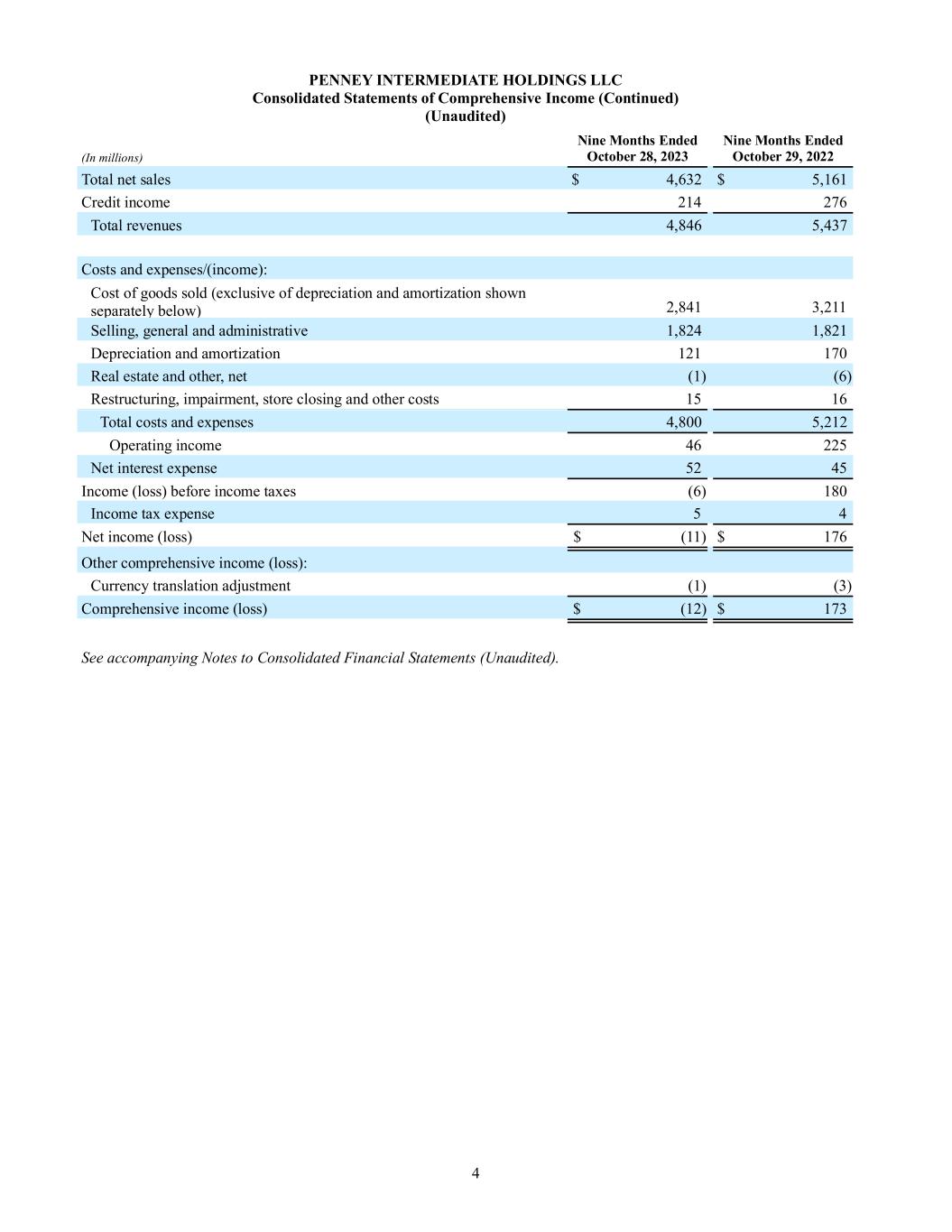

5 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Balance Sheets (Unaudited) (In millions) October 28, 2023 October 29, 2022 Assets Current assets: Cash and cash equivalents $ 106 $ 121 Merchandise inventory 2,111 2,399 Prepaid expenses and other assets 194 283 Total current assets 2,411 2,803 Property and equipment, net 1,035 848 Operating lease assets 1,688 1,622 Financing lease assets 87 76 Other assets 258 283 Total assets $ 5,479 $ 5,632 Liabilities and member’s equity Current liabilities: Merchandise accounts payable $ 501 $ 382 Other accounts payable and accrued expenses 528 589 Revolving credit facility borrowings 102 366 Current operating lease liabilities 71 48 Current financing lease liabilities 3 3 Current portion of long-term debt, net 11 9 Total current liabilities 1,216 1,397 Noncurrent operating lease liabilities 1,871 1,814 Noncurrent financing lease liabilities 96 80 Long-term debt 478 485 Other liabilities 97 142 Total liabilities 3,758 3,918 Member’s equity Member’s contributions 300 300 Profits interest plan 5 3 Accumulated other comprehensive loss (5) (5) Reinvested earnings 1,421 1,416 Total member’s equity 1,721 1,714 Total liabilities and member’s equity $ 5,479 $ 5,632 See accompanying Notes to Consolidated Financial Statements (Unaudited).

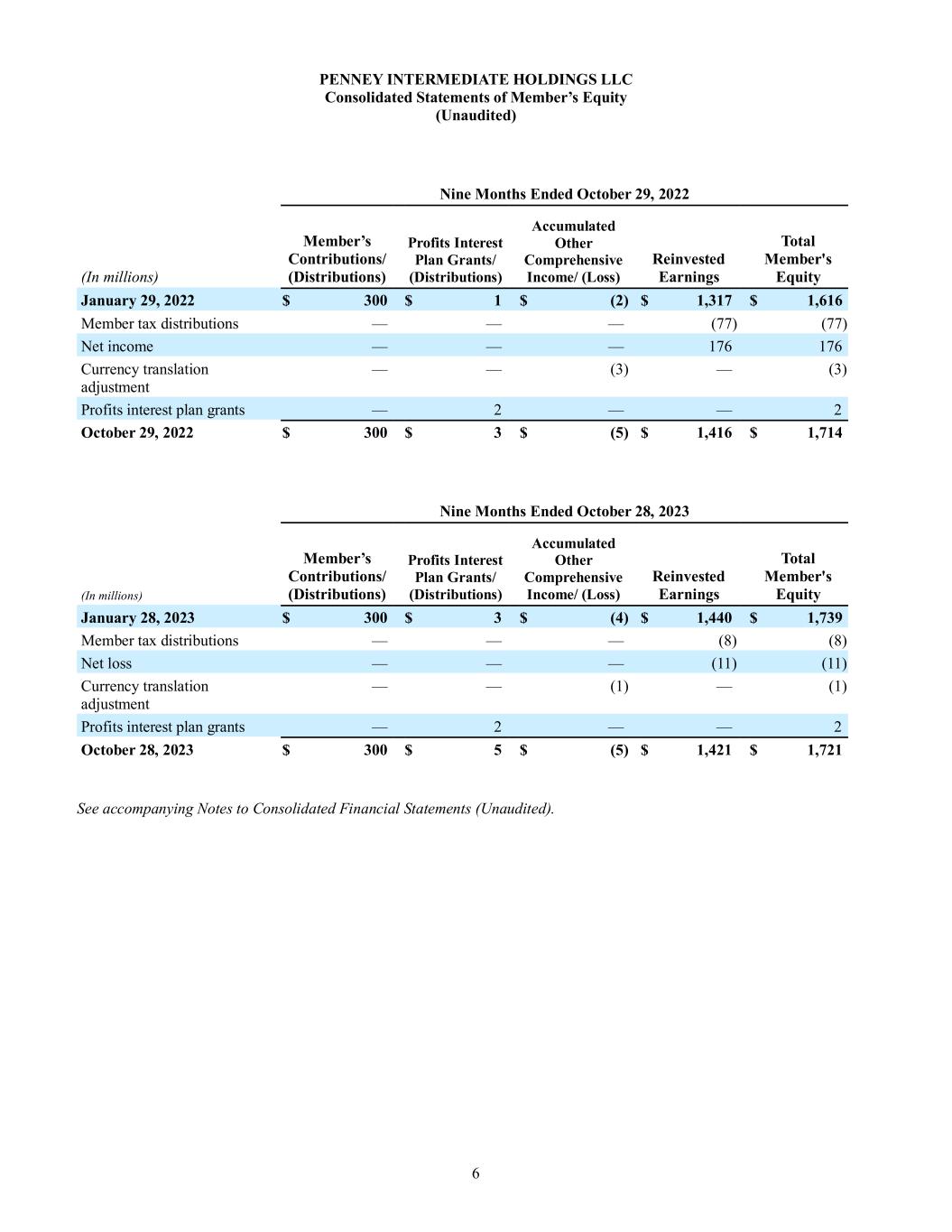

6 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Member’s Equity (Unaudited) Nine Months Ended October 29, 2022 (In millions) Member’s Contributions/ (Distributions) Profits Interest Plan Grants/ (Distributions) Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity January 29, 2022 $ 300 $ 1 $ (2) $ 1,317 $ 1,616 Member tax distributions — — — (77) (77) Net income — — — 176 176 Currency translation adjustment — — (3) — (3) Profits interest plan grants — 2 — — 2 October 29, 2022 $ 300 $ 3 $ (5) $ 1,416 $ 1,714 Nine Months Ended October 28, 2023 (In millions) Member’s Contributions/ (Distributions) Profits Interest Plan Grants/ (Distributions) Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity January 28, 2023 $ 300 $ 3 $ (4) $ 1,440 $ 1,739 Member tax distributions — — — (8) (8) Net loss — — — (11) (11) Currency translation adjustment — — (1) — (1) Profits interest plan grants — 2 — — 2 October 28, 2023 $ 300 $ 5 $ (5) $ 1,421 $ 1,721 See accompanying Notes to Consolidated Financial Statements (Unaudited).

7 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Cash Flows (Unaudited) Year-to-Date Year-to-Date (In millions) October 28, 2023 October 29, 2022 Cash flows from operating activities: Net income (loss) $ (11) $ 176 Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: Gain on asset disposition (1) (6) Restructuring, impairment, store closing and other costs, non-cash 4 5 Gain on insurance proceeds received for damage to property and equipment — (1) Depreciation and amortization 121 170 Change in cash from operating assets and liabilities: Merchandise inventory (271) (746) Prepaid expenses and other assets 15 (10) Merchandise accounts payable 237 69 Other accounts payable, accrued expenses and other liabilities 6 (105) Net cash provided (used) by operating activities 100 (448) Cash flows from investing activities: Capital expenditures (232) (129) Proceeds from sale of real estate assets 2 14 Insurance proceeds received for damage to property and equipment — 2 Net cash used by investing activities (230) (113) Cash flows from financing activities: Payments of long-term debt (6) — Proceeds from borrowings under revolving credit facility 118 366 Payments of borrowings under revolving credit facility (16) — Member tax distributions (8) (77) Repayments of principal portion of finance leases (3) (3) Net cash provided by financing activities 85 286 Net decrease in cash and cash equivalents (45) (275) Cash and cash equivalents at beginning of period 151 396 Cash and cash equivalents at end of period $ 106 $ 121 See accompanying Notes to Consolidated Financial Statements (Unaudited).

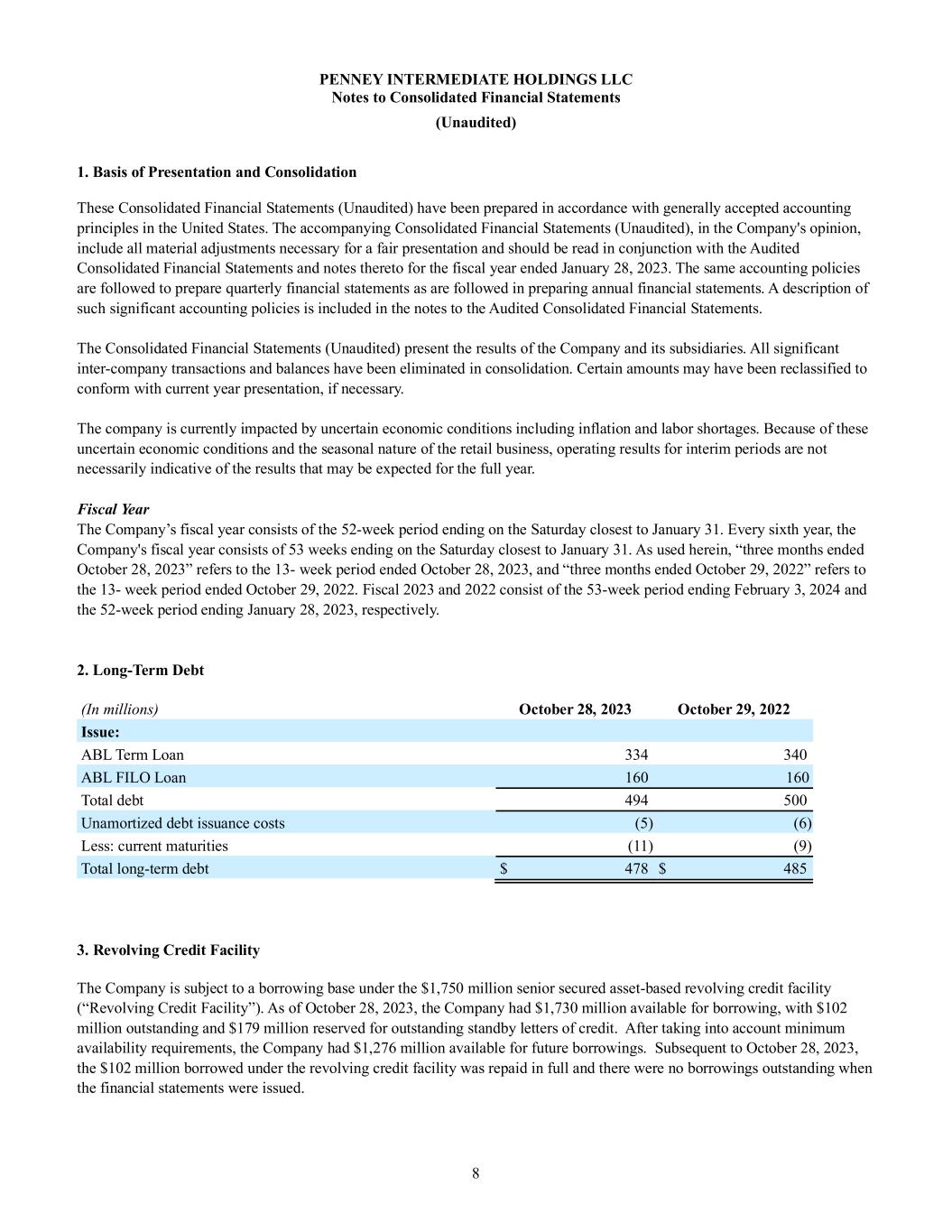

8 PENNEY INTERMEDIATE HOLDINGS LLC Notes to Consolidated Financial Statements (Unaudited) 1. Basis of Presentation and Consolidation These Consolidated Financial Statements (Unaudited) have been prepared in accordance with generally accepted accounting principles in the United States. The accompanying Consolidated Financial Statements (Unaudited), in the Company's opinion, include all material adjustments necessary for a fair presentation and should be read in conjunction with the Audited Consolidated Financial Statements and notes thereto for the fiscal year ended January 28, 2023. The same accounting policies are followed to prepare quarterly financial statements as are followed in preparing annual financial statements. A description of such significant accounting policies is included in the notes to the Audited Consolidated Financial Statements. The Consolidated Financial Statements (Unaudited) present the results of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation. Certain amounts may have been reclassified to conform with current year presentation, if necessary. The company is currently impacted by uncertain economic conditions including inflation and labor shortages. Because of these uncertain economic conditions and the seasonal nature of the retail business, operating results for interim periods are not necessarily indicative of the results that may be expected for the full year. Fiscal Year The Company’s fiscal year consists of the 52-week period ending on the Saturday closest to January 31. Every sixth year, the Company's fiscal year consists of 53 weeks ending on the Saturday closest to January 31. As used herein, “three months ended October 28, 2023” refers to the 13- week period ended October 28, 2023, and “three months ended October 29, 2022” refers to the 13- week period ended October 29, 2022. Fiscal 2023 and 2022 consist of the 53-week period ending February 3, 2024 and the 52-week period ending January 28, 2023, respectively. 2. Long-Term Debt (In millions) October 28, 2023 October 29, 2022 Issue: ABL Term Loan 334 340 ABL FILO Loan 160 160 Total debt 494 500 Unamortized debt issuance costs (5) (6) Less: current maturities (11) (9) Total long-term debt $ 478 $ 485 3. Revolving Credit Facility The Company is subject to a borrowing base under the $1,750 million senior secured asset-based revolving credit facility (“Revolving Credit Facility”). As of October 28, 2023, the Company had $1,730 million available for borrowing, with $102 million outstanding and $179 million reserved for outstanding standby letters of credit. After taking into account minimum availability requirements, the Company had $1,276 million available for future borrowings. Subsequent to October 28, 2023, the $102 million borrowed under the revolving credit facility was repaid in full and there were no borrowings outstanding when the financial statements were issued.

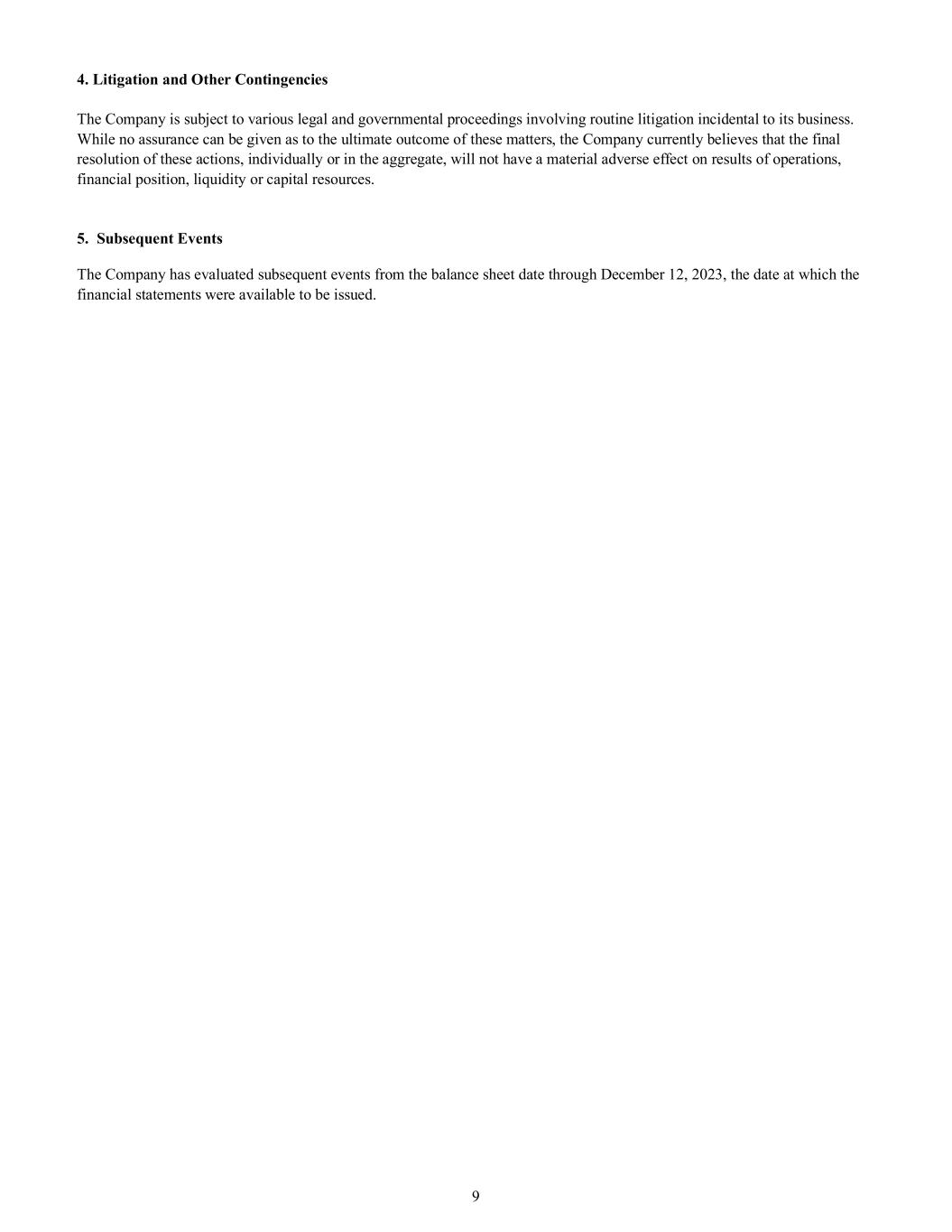

9 4. Litigation and Other Contingencies The Company is subject to various legal and governmental proceedings involving routine litigation incidental to its business. While no assurance can be given as to the ultimate outcome of these matters, the Company currently believes that the final resolution of these actions, individually or in the aggregate, will not have a material adverse effect on results of operations, financial position, liquidity or capital resources. 5. Subsequent Events The Company has evaluated subsequent events from the balance sheet date through December 12, 2023, the date at which the financial statements were available to be issued.

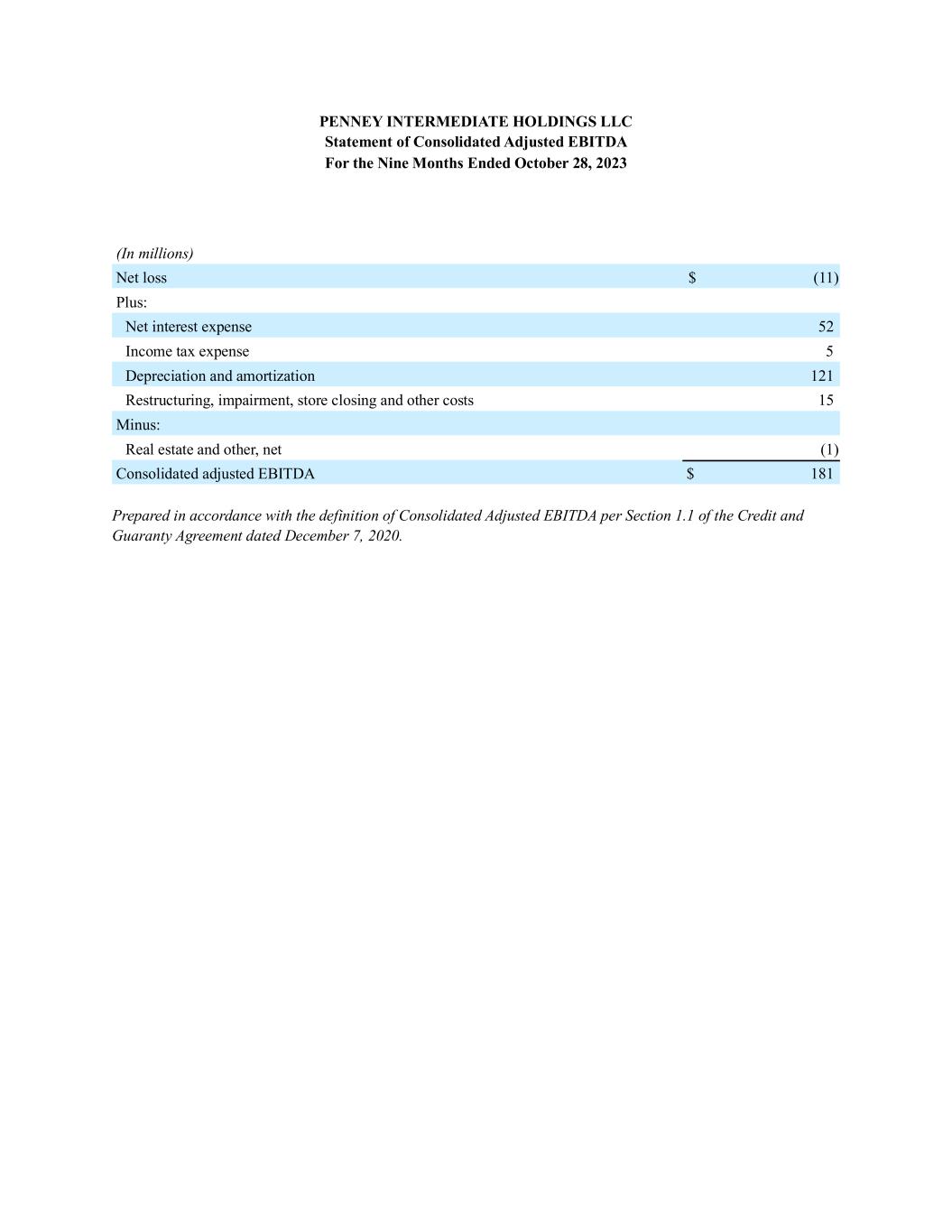

STATEMENT OF CONSOLIDATED ADJUSTED EBITDA (follows this page)

PENNEY INTERMEDIATE HOLDINGS LLC Statement of Consolidated Adjusted EBITDA For the Nine Months Ended October 28, 2023 (In millions) Net loss $ (11) Plus: Net interest expense 52 Income tax expense 5 Depreciation and amortization 121 Restructuring, impairment, store closing and other costs 15 Minus: Real estate and other, net (1) Consolidated adjusted EBITDA $ 181 Prepared in accordance with the definition of Consolidated Adjusted EBITDA per Section 1.1 of the Credit and Guaranty Agreement dated December 7, 2020.

STORE REPORTING PACKAGE (follows this page)

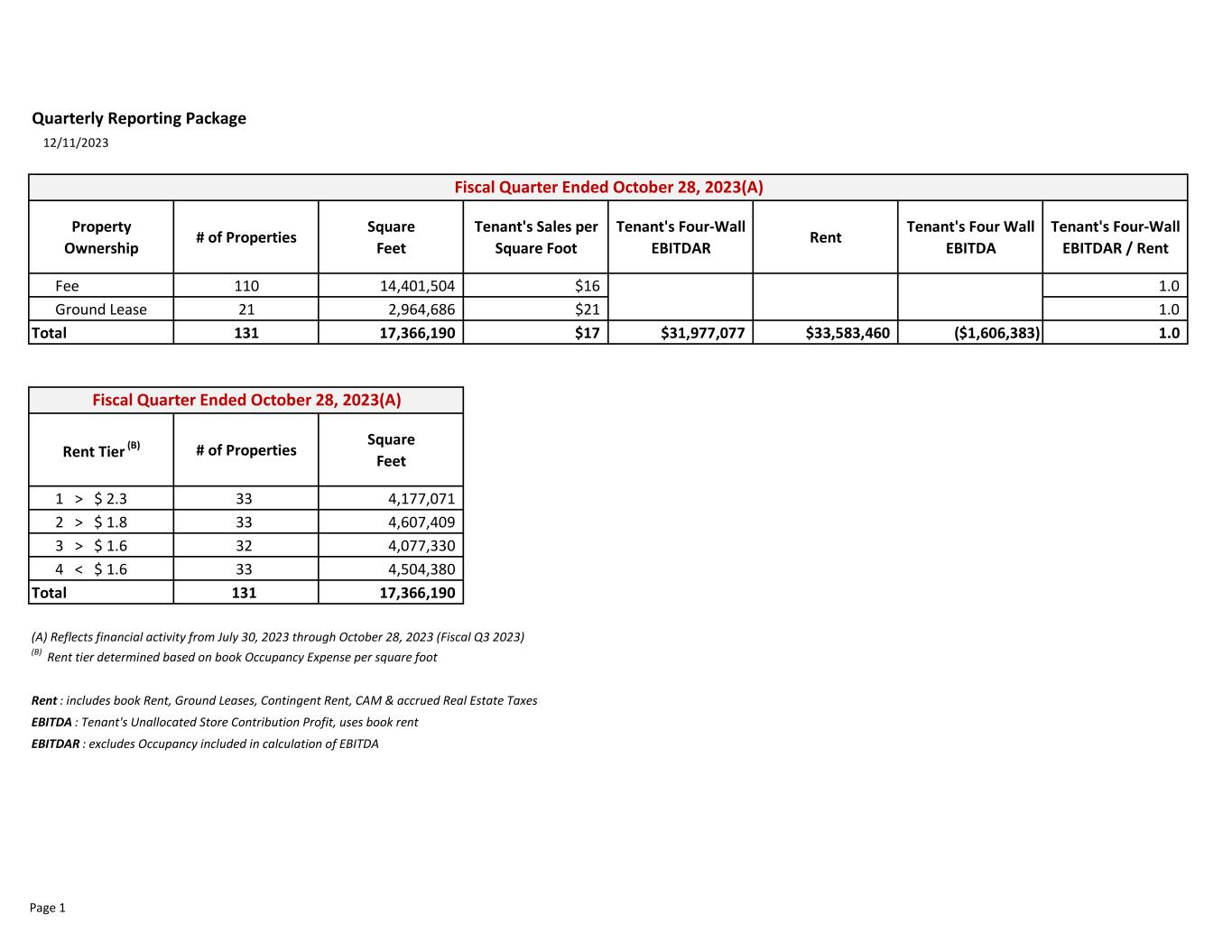

Quarterly Reporting Package 12/11/2023 Property Ownership # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent Fee 110 14,401,504 $16 $25,279,120 $26,551,212 ($1,272,092) 1.0 Ground Lease 21 2,964,686 $21 $6,697,957 $7,032,249 ($334,292) 1.0 Total 131 17,366,190 $17 $31,977,077 $33,583,460 ($1,606,383) 1.0 Rent Tier (B) # of Properties Square Feet 1 > $ 2.3 33 4,177,071 2 > $ 1.8 33 4,607,409 3 > $ 1.6 32 4,077,330 4 < $ 1.6 33 4,504,380 Total 131 17,366,190 (A) Reflects financial activity from July 30, 2023 through October 28, 2023 (Fiscal Q3 2023) (B) Rent tier determined based on book Occupancy Expense per square foot Rent : includes book Rent, Ground Leases, Contingent Rent, CAM & accrued Real Estate Taxes EBITDA : Tenant's Unallocated Store Contribution Profit, uses book rent EBITDAR : excludes Occupancy included in calculation of EBITDA Fiscal Quarter Ended October 28, 2023(A) Fiscal Quarter Ended October 28, 2023(A) Page 1

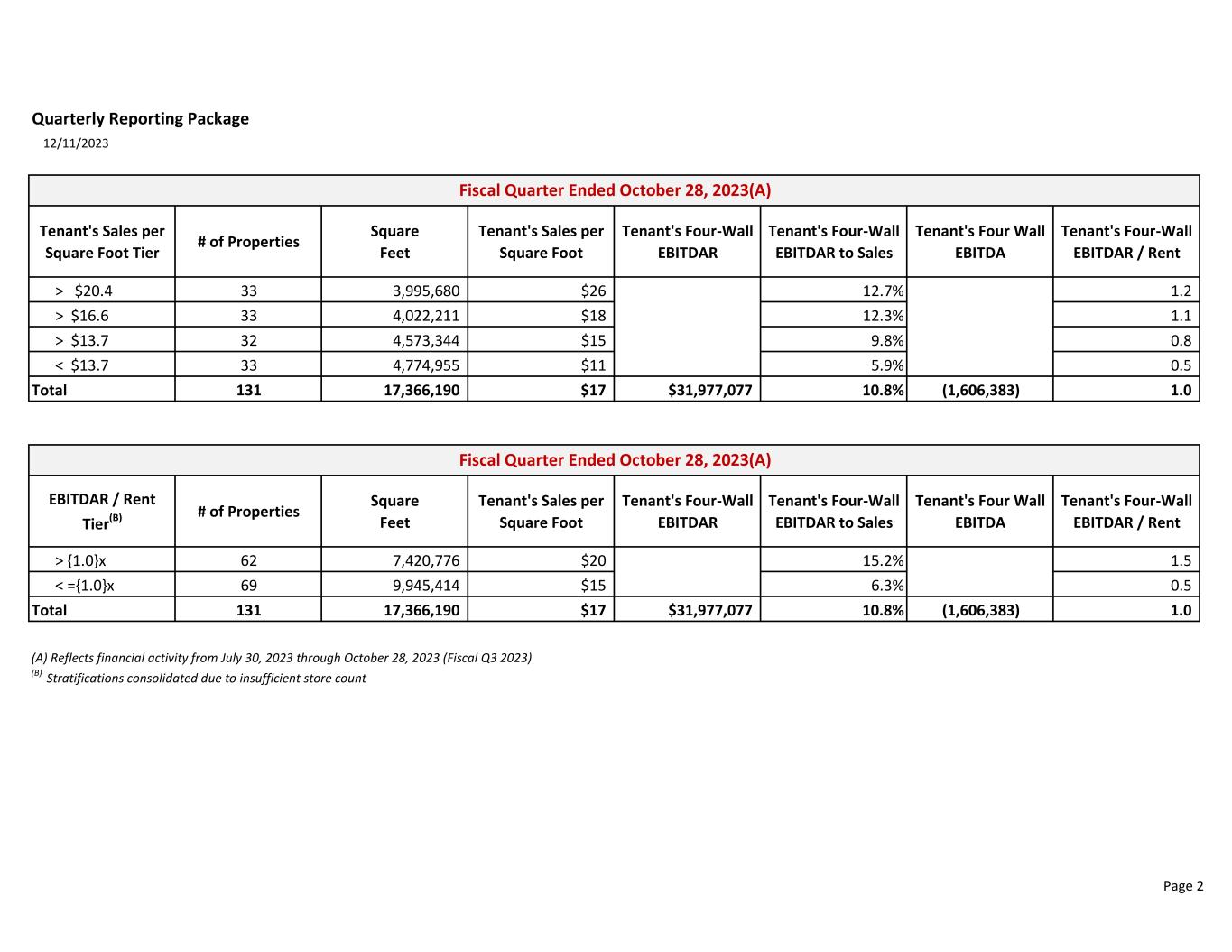

Quarterly Reporting Package 12/11/2023 Tenant's Sales per Square Foot Tier # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > $20.4 33 3,995,680 $26 12.7% 1.2 > $16.6 33 4,022,211 $18 12.3% 1.1 > $13.7 32 4,573,344 $15 9.8% 0.8 < $13.7 33 4,774,955 $11 5.9% 0.5 Total 131 17,366,190 $17 $31,977,077 10.8% (1,606,383) 1.0 EBITDAR / Rent Tier(B) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > {1.0}x 62 7,420,776 $20 15.2% 1.5 < ={1.0}x 69 9,945,414 $15 6.3% 0.5 Total 131 17,366,190 $17 $31,977,077 10.8% (1,606,383) 1.0 (A) Reflects financial activity from July 30, 2023 through October 28, 2023 (Fiscal Q3 2023) (B) Stratifications consolidated due to insufficient store count Fiscal Quarter Ended October 28, 2023(A) Fiscal Quarter Ended October 28, 2023(A) Page 2

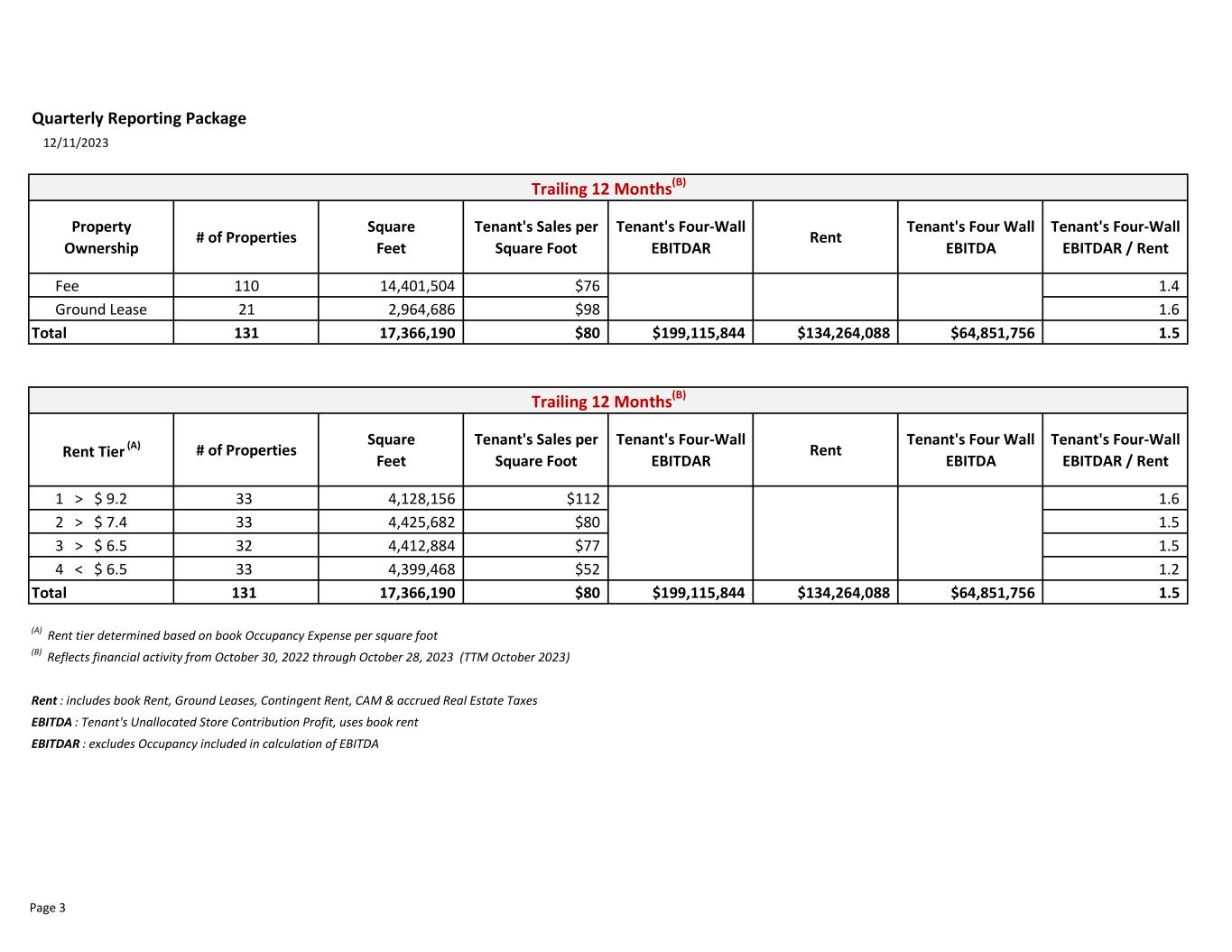

Quarterly Reporting Package 12/11/2023 Property Ownership # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent Fee 110 14,401,504 $76 $153,433,429 $105,820,193 $47,613,236 1.4 Ground Lease 21 2,964,686 $98 $45,682,415 $28,443,895 $17,238,520 1.6 Total 131 17,366,190 $80 $199,115,844 $134,264,088 $64,851,756 1.5 Rent Tier (A) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent 1 > $ 9.2 33 4,128,156 $112 $77,225,500 $46,862,731 1.6 2 > $ 7.4 33 4,425,682 $80 $53,537,113 $36,423,787 1.5 3 > $ 6.5 32 4,412,884 $77 $44,534,545 $30,680,853 1.5 4 < $ 6.5 33 4,399,468 $52 $23,818,686 $20,296,717 1.2 Total 131 17,366,190 $80 $199,115,844 $134,264,088 $64,851,756 1.5 (A) Rent tier determined based on book Occupancy Expense per square foot (B) Reflects financial activity from October 30, 2022 through October 28, 2023 (TTM October 2023) Rent : includes book Rent, Ground Leases, Contingent Rent, CAM & accrued Real Estate Taxes EBITDA : Tenant's Unallocated Store Contribution Profit, uses book rent EBITDAR : excludes Occupancy included in calculation of EBITDA Trailing 12 Months(B) Trailing 12 Months(B) Page 3

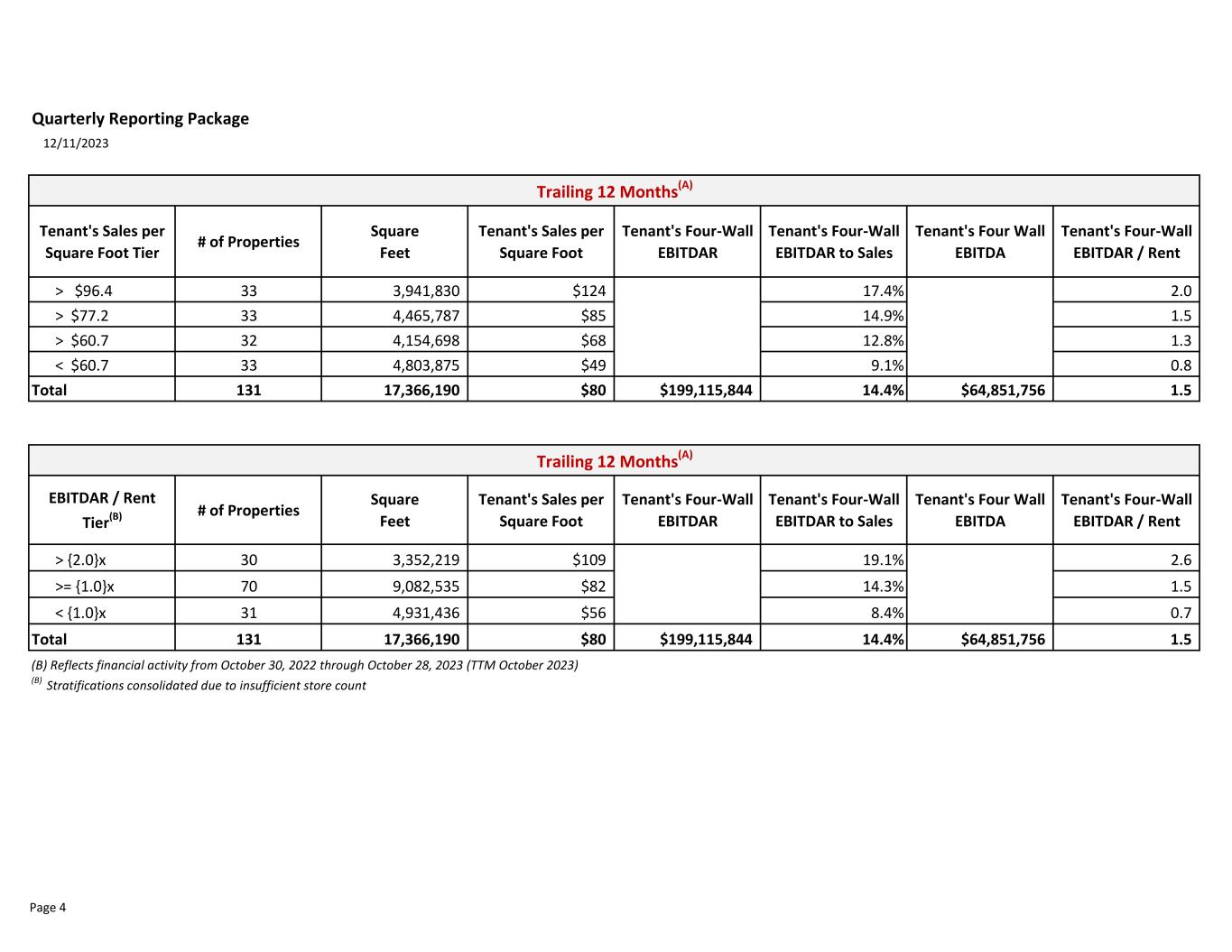

Quarterly Reporting Package 12/11/2023 Tenant's Sales per Square Foot Tier # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > $96.4 33 3,941,830 $124 17.4% 2.0 > $77.2 33 4,465,787 $85 14.9% 1.5 > $60.7 32 4,154,698 $68 12.8% 1.3 < $60.7 33 4,803,875 $49 9.1% 0.8 Total 131 17,366,190 $80 $199,115,844 14.4% $64,851,756 1.5 EBITDAR / Rent Tier(B) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > {2.0}x 30 3,352,219 $109 19.1% 2.6 >= {1.0}x 70 9,082,535 $82 14.3% 1.5 < {1.0}x 31 4,931,436 $56 8.4% 0.7 Total 131 17,366,190 $80 $199,115,844 14.4% $64,851,756 1.5 (B) Reflects financial activity from October 30, 2022 through October 28, 2023 (TTM October 2023) (B) Stratifications consolidated due to insufficient store count Trailing 12 Months(A) Trailing 12 Months(A) Page 4

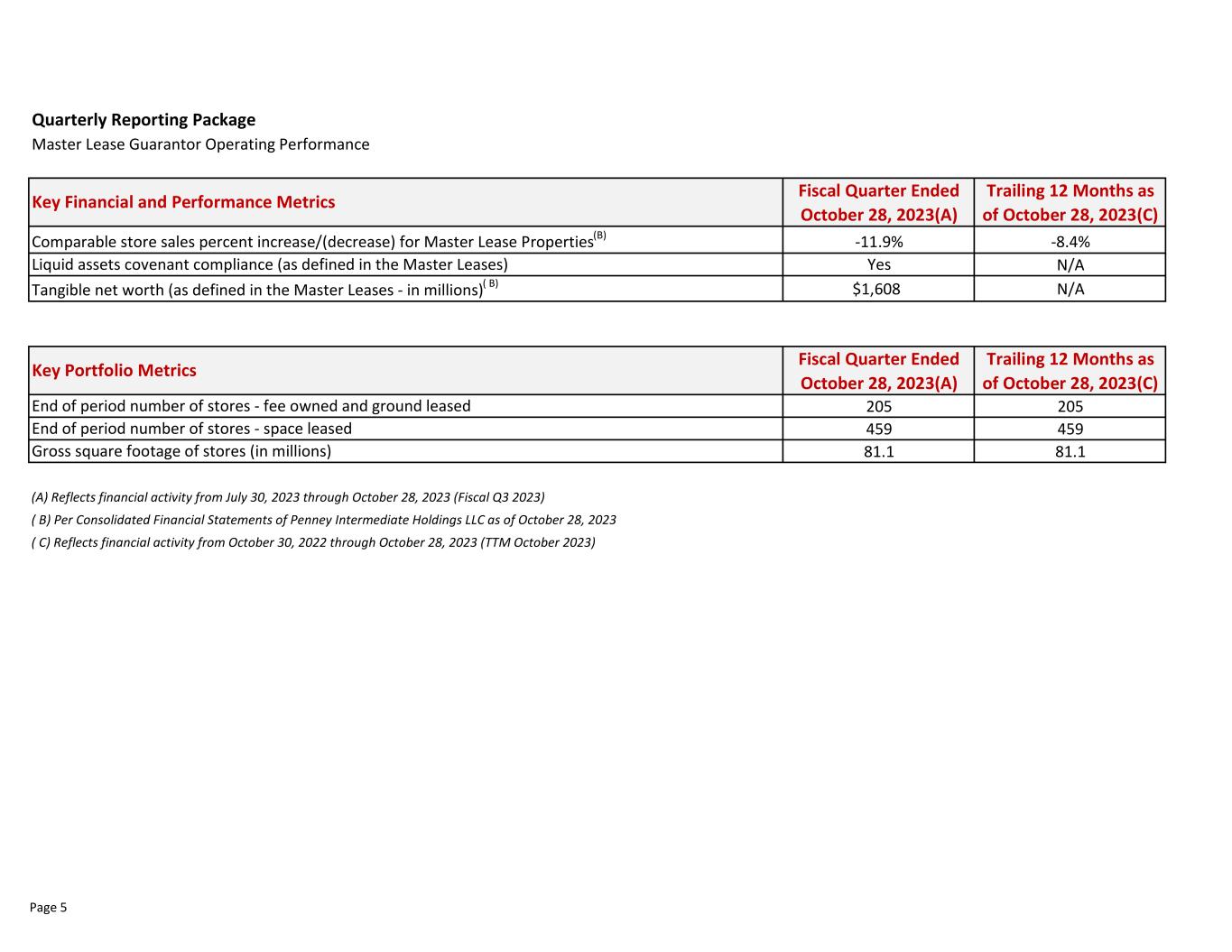

Quarterly Reporting Package Master Lease Guarantor Operating Performance Fiscal Quarter Ended October 28, 2023(A) Trailing 12 Months as of October 28, 2023(C) -11.9% -8.4% Yes N/A $1,608 N/A Fiscal Quarter Ended October 28, 2023(A) Trailing 12 Months as of October 28, 2023(C) 205 205 459 459 81.1 81.1 (A) Reflects financial activity from July 30, 2023 through October 28, 2023 (Fiscal Q3 2023) ( B) Per Consolidated Financial Statements of Penney Intermediate Holdings LLC as of October 28, 2023 ( C) Reflects financial activity from October 30, 2022 through October 28, 2023 (TTM October 2023) End of period number of stores - space leased Gross square footage of stores (in millions) Key Financial and Performance Metrics Comparable store sales percent increase/(decrease) for Master Lease Properties(B) Liquid assets covenant compliance (as defined in the Master Leases) Tangible net worth (as defined in the Master Leases - in millions)( B) Key Portfolio Metrics End of period number of stores - fee owned and ground leased Page 5