1 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) May 3, 2025 and May 4, 2024

Penney Intermediate Holdings LLC Narrative Report The following discussion, which presents results for the first quarter, should be read in conjunction with the accompanying Consolidated Financial Statements and notes thereto. Unless otherwise indicated, all references in Narrative are as of the date presented and the Company does not undertake any obligation to update these numbers, or to revise or update any statement being made related thereto. First Quarter Update During first quarter of Fiscal 2025, JCPenney continued its efforts to celebrate and serve America’s hard- working families. At the start of the quarter, the US Economy was under pressure from significant upheaval related to social unrest, government spending reductions and international disputes, followed by the announcement of additional tariffs on imported goods – all of which put significant pressure on store traffic and overall consumer spending. At the end of the period, the Company launched a new overarching platform for the brand - Yes, JCPenney - that is focused on changing perceptions about JCPenney and building consideration about the availability of surprisingly strong fashion at a surprisingly strong value. In combination with this launch, the return of the Company’s “Really Big Deals” program was executed with a first of its kind integration with “Jimmy Kimmel Live.” This highly effective combination resonated with consumers and as a result, trends steadily improved throughout the quarter, generating a 600 bp traffic improvement over last year, a 22% year-over-year lift in brand search demand and a 10 ppt improvement with a younger, fashion forward customer. Additionally, the Company saw positive year-over-year growth in April from existing customers following the launch of the new marketing. E-Commerce conversion in the first quarter also improved over prior year driven primarily by strong clearance sales and lower free shipping thresholds for customers. During the period, the strongest performing categories were fine jewelry and home, both of which exceeded expectations and posted positive comps for the period. Men’s apparel and kids also outperformed expectations for the period. JCPBeauty continued its growth trend, posting a double-digit positive comp to last year, led again by its strongest performer, fragrance. Gross Margins remained strong at 38.4% despite increased markdown and promotional activity and increased shipping costs. Selling, general, and administrative costs were $36M lower than last year and were below plan due to continued cost controls. Cost synergies with the recent Catalyst Brands transaction contributed to lower overall administrative costs and reduced digital marketing spend. Credit income was $61M, an increase of $3M over last year with improved portfolio profitability and gain share. The company is actively managing potential impacts from the recently announced government tariffs on imported goods. Although the exact impact of the announcement remains unclear, as of the date of this report, proposed tariffs could have a negative impact on profitability. The Company had previously reduced exposure to imports from China and since the date of the announcement has further reduced exposure to nearly zero. Going forward, the Company will continue to minimize potential tariff impacts, where possible. Given the Company’s commitment to provide hard working American families with affordable fashion, it plans to maintain pre-tariff pricing on back-to-school basics and other key holiday areas. During the quarter, the Company used cash of $129M primarily to fund operations, seasonal purchases of inventory and capital expenditures of $18M for projects aimed at driving long-term growth of the business. The Company reported AEBITDA of $2M when excluding one-time restructuring charges primarily related to losses associated with vendor write-offs and other severance charges. The Company continues to prioritize maintaining a healthy balance sheet with sufficient available liquidity for future investment in operations and capital improvements. Overall, the Company has less than $480M of outstanding long-term debt and, as of the end of the period, had no outstanding borrowings on its line of credit.

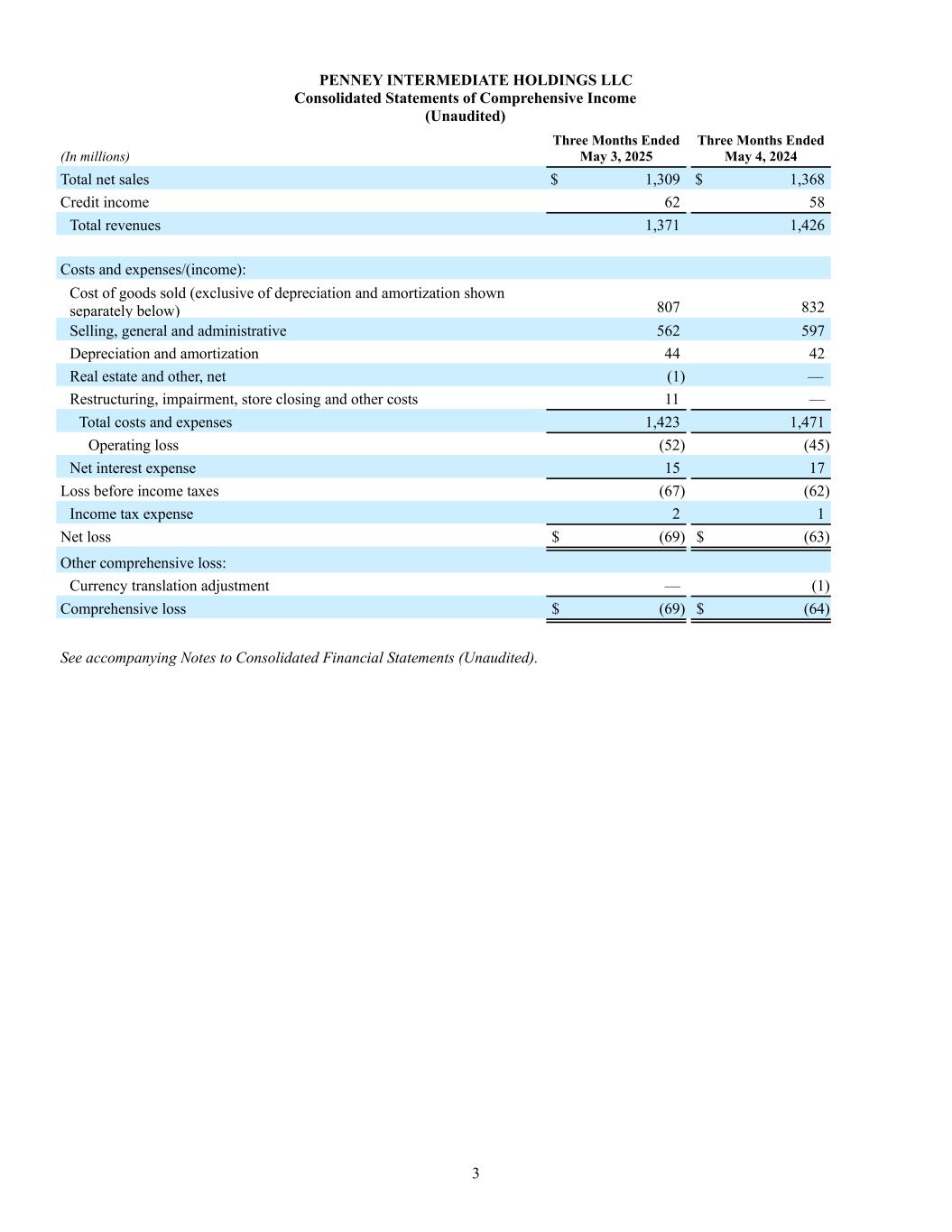

3 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Unaudited) (In millions) Three Months Ended May 3, 2025 Three Months Ended May 4, 2024 Total net sales $ 1,309 $ 1,368 Credit income 62 58 Total revenues 1,371 1,426 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 807 832 Selling, general and administrative 562 597 Depreciation and amortization 44 42 Real estate and other, net (1) — Restructuring, impairment, store closing and other costs 11 — Total costs and expenses 1,423 1,471 Operating loss (52) (45) Net interest expense 15 17 Loss before income taxes (67) (62) Income tax expense 2 1 Net loss $ (69) $ (63) Other comprehensive loss: Currency translation adjustment — (1) Comprehensive loss $ (69) $ (64) See accompanying Notes to Consolidated Financial Statements (Unaudited).

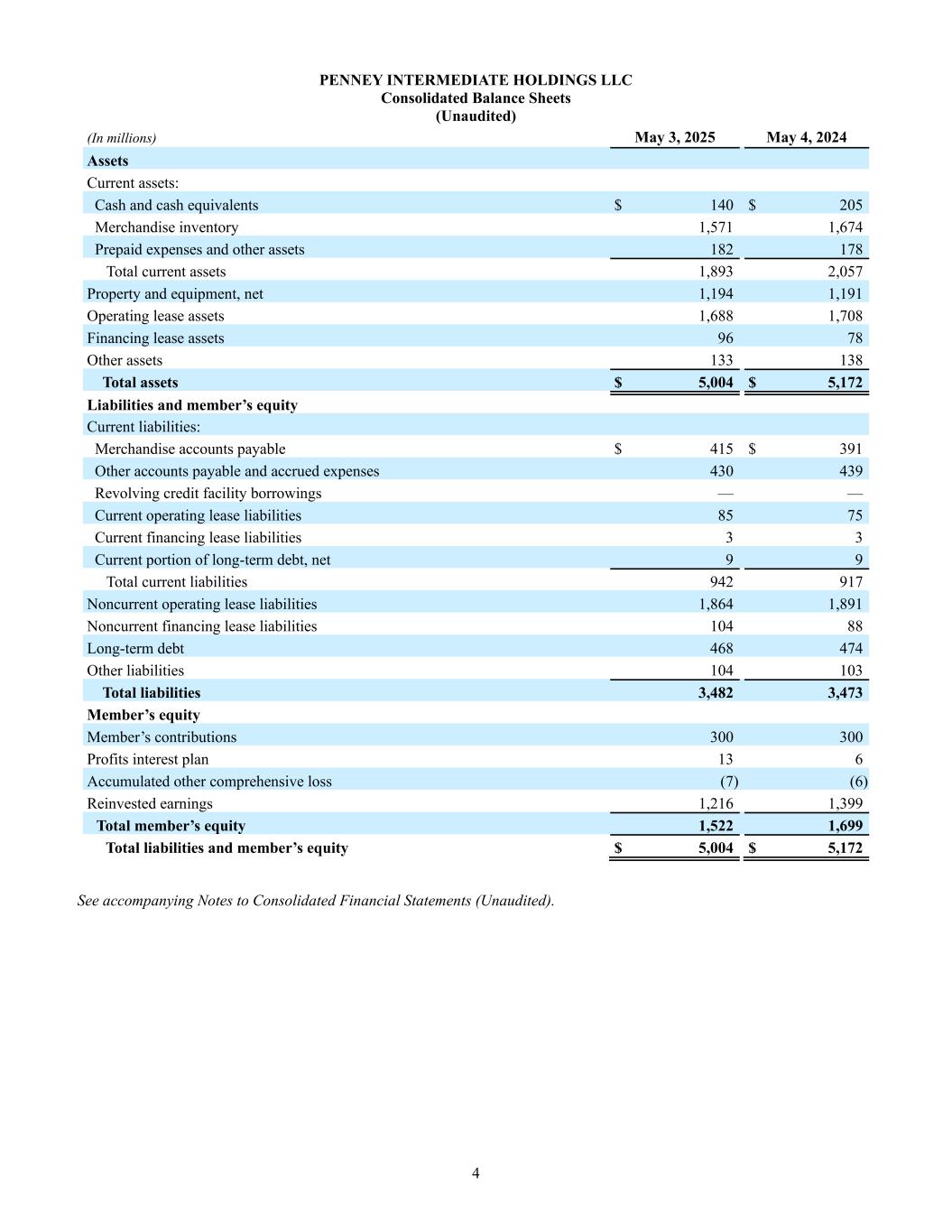

4 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Balance Sheets (Unaudited) (In millions) May 3, 2025 May 4, 2024 Assets Current assets: Cash and cash equivalents $ 140 $ 205 Merchandise inventory 1,571 1,674 Prepaid expenses and other assets 182 178 Total current assets 1,893 2,057 Property and equipment, net 1,194 1,191 Operating lease assets 1,688 1,708 Financing lease assets 96 78 Other assets 133 138 Total assets $ 5,004 $ 5,172 Liabilities and member’s equity Current liabilities: Merchandise accounts payable $ 415 $ 391 Other accounts payable and accrued expenses 430 439 Revolving credit facility borrowings — — Current operating lease liabilities 85 75 Current financing lease liabilities 3 3 Current portion of long-term debt, net 9 9 Total current liabilities 942 917 Noncurrent operating lease liabilities 1,864 1,891 Noncurrent financing lease liabilities 104 88 Long-term debt 468 474 Other liabilities 104 103 Total liabilities 3,482 3,473 Member’s equity Member’s contributions 300 300 Profits interest plan 13 6 Accumulated other comprehensive loss (7) (6) Reinvested earnings 1,216 1,399 Total member’s equity 1,522 1,699 Total liabilities and member’s equity $ 5,004 $ 5,172 See accompanying Notes to Consolidated Financial Statements (Unaudited).

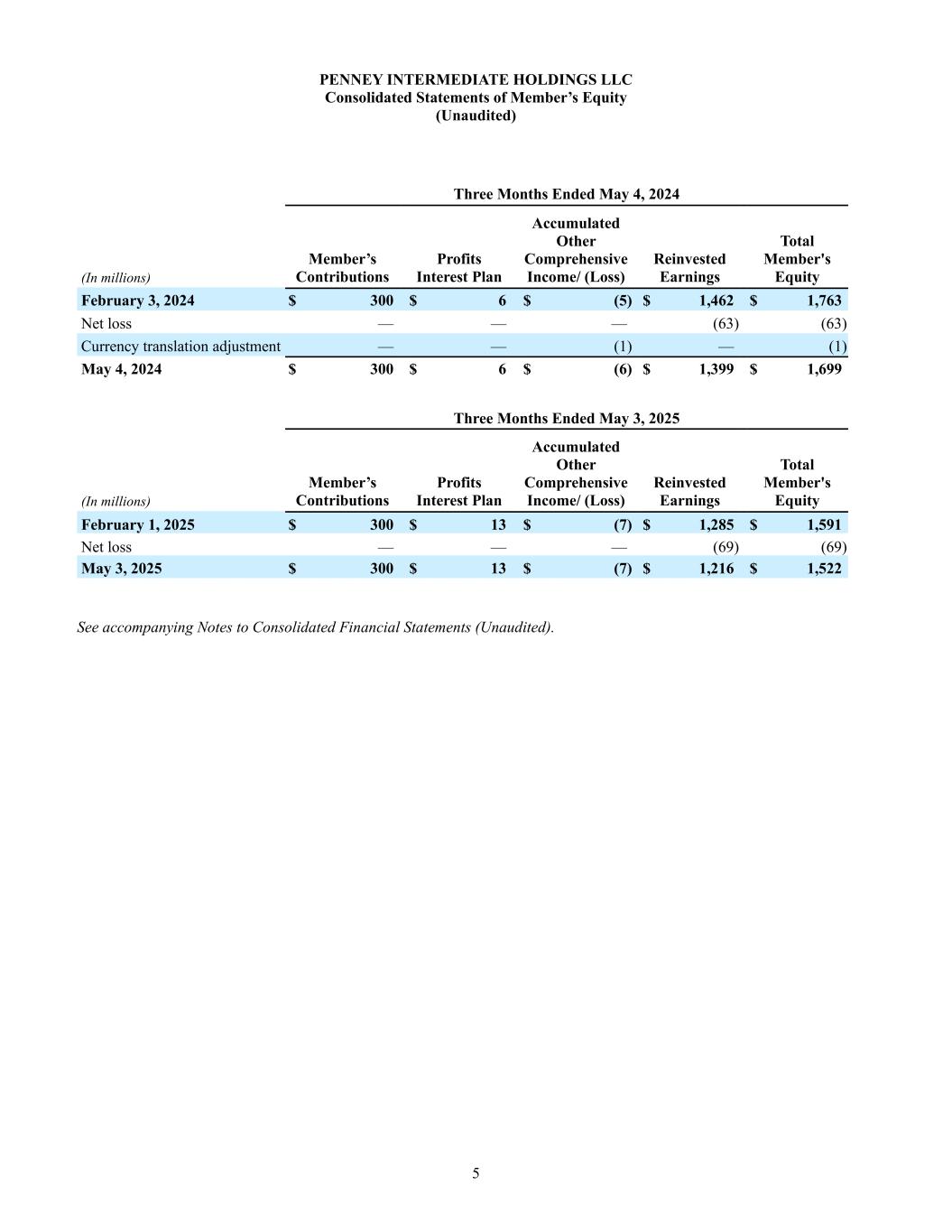

5 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Member’s Equity (Unaudited) Three Months Ended May 4, 2024 (In millions) Member’s Contributions Profits Interest Plan Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity February 3, 2024 $ 300 $ 6 $ (5) $ 1,462 $ 1,763 Net loss — — — (63) (63) Currency translation adjustment — — (1) — (1) May 4, 2024 $ 300 $ 6 $ (6) $ 1,399 $ 1,699 Three Months Ended May 3, 2025 (In millions) Member’s Contributions Profits Interest Plan Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity February 1, 2025 $ 300 $ 13 $ (7) $ 1,285 $ 1,591 Net loss — — — (69) (69) May 3, 2025 $ 300 $ 13 $ (7) $ 1,216 $ 1,522 See accompanying Notes to Consolidated Financial Statements (Unaudited).

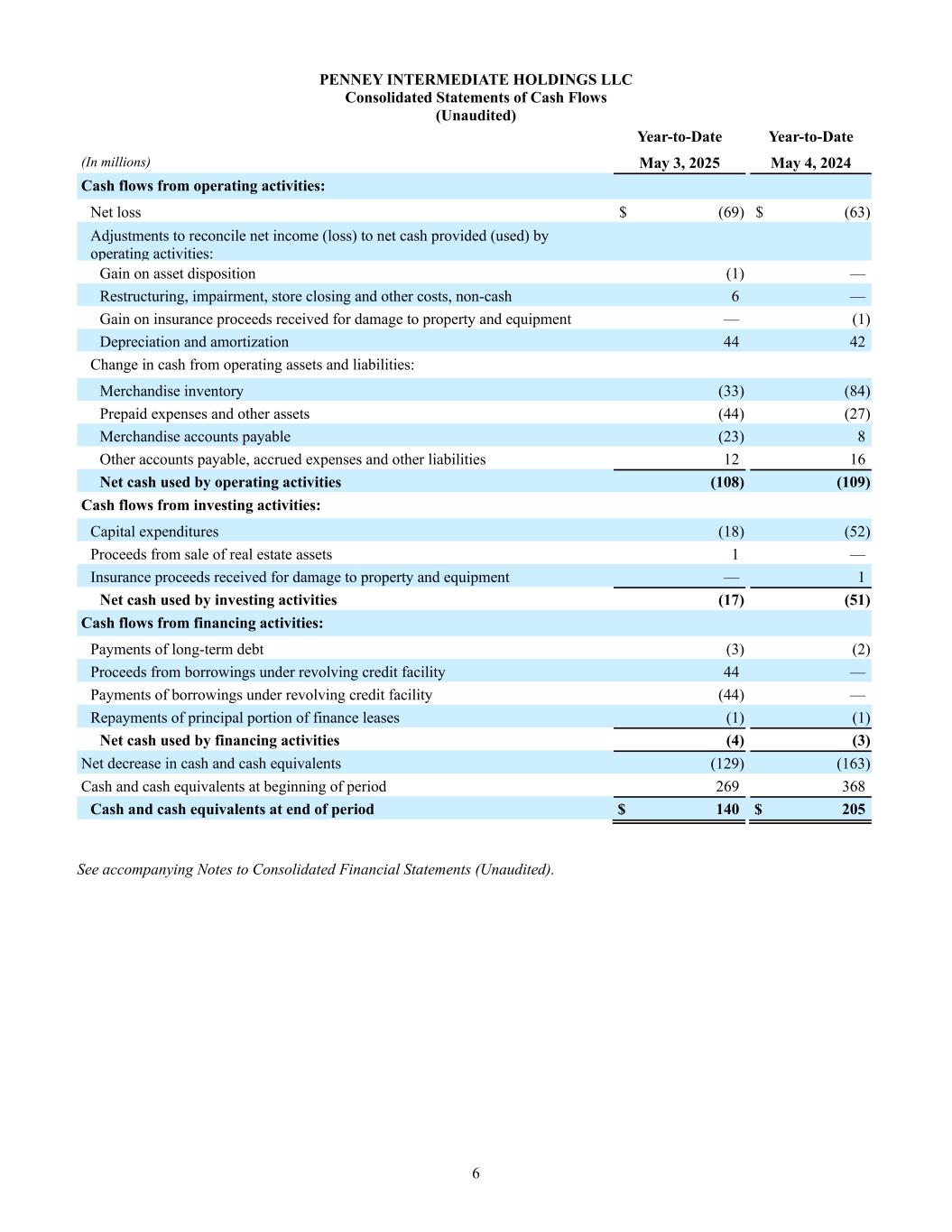

6 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Cash Flows (Unaudited) Year-to-Date Year-to-Date (In millions) May 3, 2025 May 4, 2024 Cash flows from operating activities: Net loss $ (69) $ (63) Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: Gain on asset disposition (1) — Restructuring, impairment, store closing and other costs, non-cash 6 — Gain on insurance proceeds received for damage to property and equipment — (1) Depreciation and amortization 44 42 Change in cash from operating assets and liabilities: Merchandise inventory (33) (84) Prepaid expenses and other assets (44) (27) Merchandise accounts payable (23) 8 Other accounts payable, accrued expenses and other liabilities 12 16 Net cash used by operating activities (108) (109) Cash flows from investing activities: Capital expenditures (18) (52) Proceeds from sale of real estate assets 1 — Insurance proceeds received for damage to property and equipment — 1 Net cash used by investing activities (17) (51) Cash flows from financing activities: Payments of long-term debt (3) (2) Proceeds from borrowings under revolving credit facility 44 — Payments of borrowings under revolving credit facility (44) — Repayments of principal portion of finance leases (1) (1) Net cash used by financing activities (4) (3) Net decrease in cash and cash equivalents (129) (163) Cash and cash equivalents at beginning of period 269 368 Cash and cash equivalents at end of period $ 140 $ 205 See accompanying Notes to Consolidated Financial Statements (Unaudited).

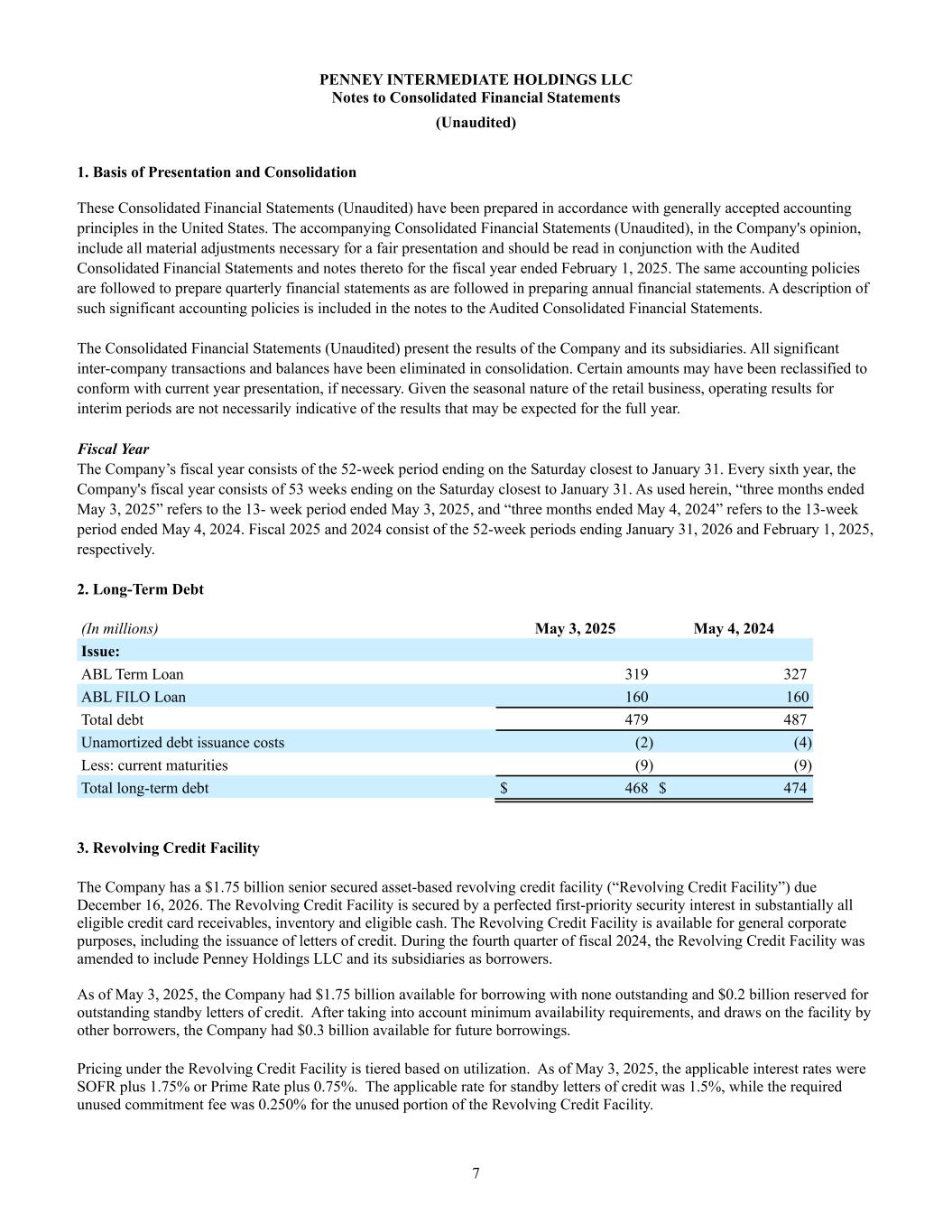

7 PENNEY INTERMEDIATE HOLDINGS LLC Notes to Consolidated Financial Statements (Unaudited) 1. Basis of Presentation and Consolidation These Consolidated Financial Statements (Unaudited) have been prepared in accordance with generally accepted accounting principles in the United States. The accompanying Consolidated Financial Statements (Unaudited), in the Company's opinion, include all material adjustments necessary for a fair presentation and should be read in conjunction with the Audited Consolidated Financial Statements and notes thereto for the fiscal year ended February 1, 2025. The same accounting policies are followed to prepare quarterly financial statements as are followed in preparing annual financial statements. A description of such significant accounting policies is included in the notes to the Audited Consolidated Financial Statements. The Consolidated Financial Statements (Unaudited) present the results of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation. Certain amounts may have been reclassified to conform with current year presentation, if necessary. Given the seasonal nature of the retail business, operating results for interim periods are not necessarily indicative of the results that may be expected for the full year. Fiscal Year The Company’s fiscal year consists of the 52-week period ending on the Saturday closest to January 31. Every sixth year, the Company's fiscal year consists of 53 weeks ending on the Saturday closest to January 31. As used herein, “three months ended May 3, 2025” refers to the 13- week period ended May 3, 2025, and “three months ended May 4, 2024” refers to the 13-week period ended May 4, 2024. Fiscal 2025 and 2024 consist of the 52-week periods ending January 31, 2026 and February 1, 2025, respectively. 2. Long-Term Debt (In millions) May 3, 2025 May 4, 2024 Issue: ABL Term Loan 319 327 ABL FILO Loan 160 160 Total debt 479 487 Unamortized debt issuance costs (2) (4) Less: current maturities (9) (9) Total long-term debt $ 468 $ 474 3. Revolving Credit Facility The Company has a $1.75 billion senior secured asset-based revolving credit facility (“Revolving Credit Facility”) due December 16, 2026. The Revolving Credit Facility is secured by a perfected first-priority security interest in substantially all eligible credit card receivables, inventory and eligible cash. The Revolving Credit Facility is available for general corporate purposes, including the issuance of letters of credit. During the fourth quarter of fiscal 2024, the Revolving Credit Facility was amended to include Penney Holdings LLC and its subsidiaries as borrowers. As of May 3, 2025, the Company had $1.75 billion available for borrowing with none outstanding and $0.2 billion reserved for outstanding standby letters of credit. After taking into account minimum availability requirements, and draws on the facility by other borrowers, the Company had $0.3 billion available for future borrowings. Pricing under the Revolving Credit Facility is tiered based on utilization. As of May 3, 2025, the applicable interest rates were SOFR plus 1.75% or Prime Rate plus 0.75%. The applicable rate for standby letters of credit was 1.5%, while the required unused commitment fee was 0.250% for the unused portion of the Revolving Credit Facility.

8 4. Litigation and Other Contingencies The Company is subject to various legal and governmental proceedings involving routine litigation incidental to its business. While no assurance can be given as to the ultimate outcome of these matters, the Company currently believes that the final resolution of these actions, individually or in the aggregate, will not have a material adverse effect on results of operations, financial position, liquidity or capital resources. 5. Subsequent Events The Company has evaluated subsequent events from the balance sheet date through June 17, 2025, the date at which the financial statements were available to be issued.

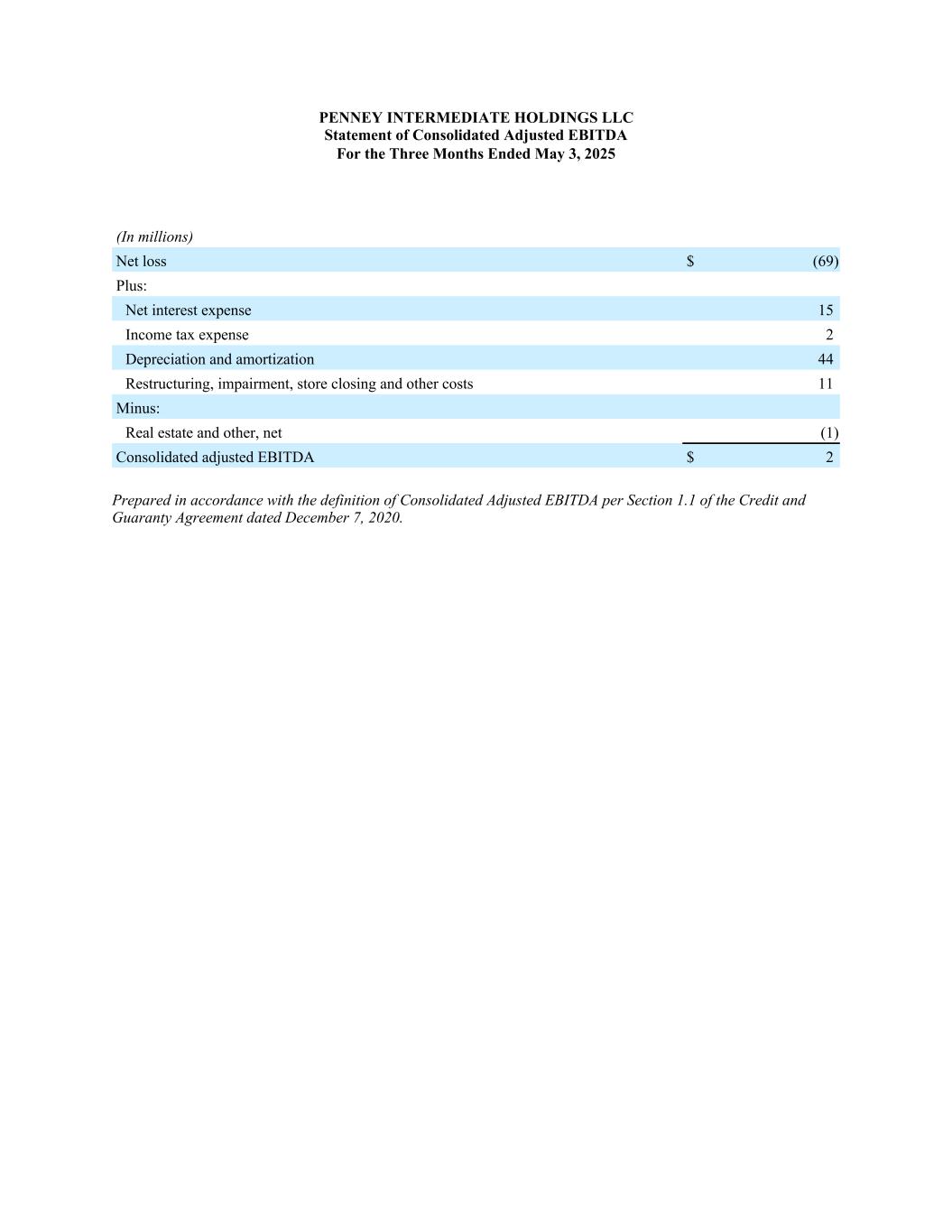

STATEMENT OF CONSOLIDATED ADJUSTED EBITDA (follows this page)

PENNEY INTERMEDIATE HOLDINGS LLC Statement of Consolidated Adjusted EBITDA For the Three Months Ended May 3, 2025 (In millions) Net loss $ (69) Plus: Net interest expense 15 Income tax expense 2 Depreciation and amortization 44 Restructuring, impairment, store closing and other costs 11 Minus: Real estate and other, net (1) Consolidated adjusted EBITDA $ 2 Prepared in accordance with the definition of Consolidated Adjusted EBITDA per Section 1.1 of the Credit and Guaranty Agreement dated December 7, 2020.