1 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) August 2, 2025 and August 3, 2024

Penney Intermediate Holdings LLC Narrative Report The following discussion, which presents results for the second quarter, should be read in conjunction with the accompanying Consolidated Financial Statements and notes thereto. Unless otherwise indicated, all references in Narrative are as of the date presented and the Company does not undertake any obligation to update these numbers, or to revise or update any statement being made related thereto. Second Quarter Update During second quarter of Fiscal 2025, JCPenney remained focused on serving as the shopping destination for America’s diverse, working families. The second quarter continued to build on the momentum generated by the disruptive marketing that began at the end of April. Customers responded very favorably and as a result, traffic trends continued to improve over those seen in the first quarter in both the store and ecommerce channels. Trip frequency improved an additional 1% marking the Company’s 15th consecutive month of existing customer frequency increase. Sales growth trends in physical stores continued to improve and resulted in a significant increase in the number of stores generating positive comparable store sales growth over the same period last year. The Company also experienced meaningful growth in brand search interest, site traffic and site demand throughout the quarter. As a result of all these positive developments, the Company’s second quarter sales exceeded expectations despite the economic challenges its customers continued to face throughout the period. In June, the success of the Company’s continuing transformational efforts was evidenced by JCPenney’s selection as America’s favorite department store for the third year in a row by the readers of USA Today. In terms of category performance in the second quarter, the strongest performing categories were beauty, fine jewelry, and home. The best performing private brands included Xersion, Modern Bride, Arizona and Liz Claiborne complimented by strong national brand performance from Clarks, Skechers, and Adidas. In terms of gross margin growth, significant increases were seen across many areas of the business including basics and sleepwear, footwear, home, childrens and mens apparel. These category margin increases are attributed to improved markdown management, which allowed the Company to manage the impact of distribution and tariff cost increases. Overall, the Company’s gross profit margin remained strong at 38.7%. Selling, general, and administrative costs were down significantly compared to last year. The reduction can primarily be attributed to a legal settlement received related to credit card processing charges in addition to reductions in administrative, advertising and technology spend in the period. Cost savings achieved were slightly offset by increases in incentive compensation accrual estimates. Credit income for the period was $65M, an increase of $6M over last year with improved portfolio profitability and gain share driving the increase. The Company continues the work of achieving synergies related to its parent Company’s acquisition of Sparc Group Holdings LLC and to date the Company has identified significant levels of synergies that will be realized by JCPenney by the year 2027. The identified synergies relate primarily to savings in sourcing, distribution, and technology costs as well as savings from consolidation of administrative expenses. The Company generated approximately $96M of cash during the period. Primary uses of cash in the quarter included seasonal purchases of inventory and capital expenditures totaling $35M aimed at driving long- term growth of the business. The Company reported AEBITDA of $177M when excluding one-time restructuring charges. The Company continues to prioritize a very healthy balance sheet and significant liquidity. At the end of the period, the Company had no outstanding borrowings on its line of credit and approximately $500M of available liquidity for future investment in operations or capital for the business. Subsequent to the end of the period, the Company’s parent completed the amendment and extension of its $1.75B credit facility and extended the maturity to the year 2030. Additionally, a capital investment provided by its parent, Penney Holdings LLC retired the remaining long term debt balance of $475M. As of the date of this report, the Company had no outstanding debt remaining on its balance sheet.

2 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) August 2, 2025 and August 3, 2024 Table of Contents Page Consolidated Statements of Comprehensive Income (Loss) 3 Consolidated Balance Sheets 5 Consolidated Statements of Member’s Equity 6 Consolidated Statements of Cash Flows 7 Notes to the Consolidated Financial Statements 8

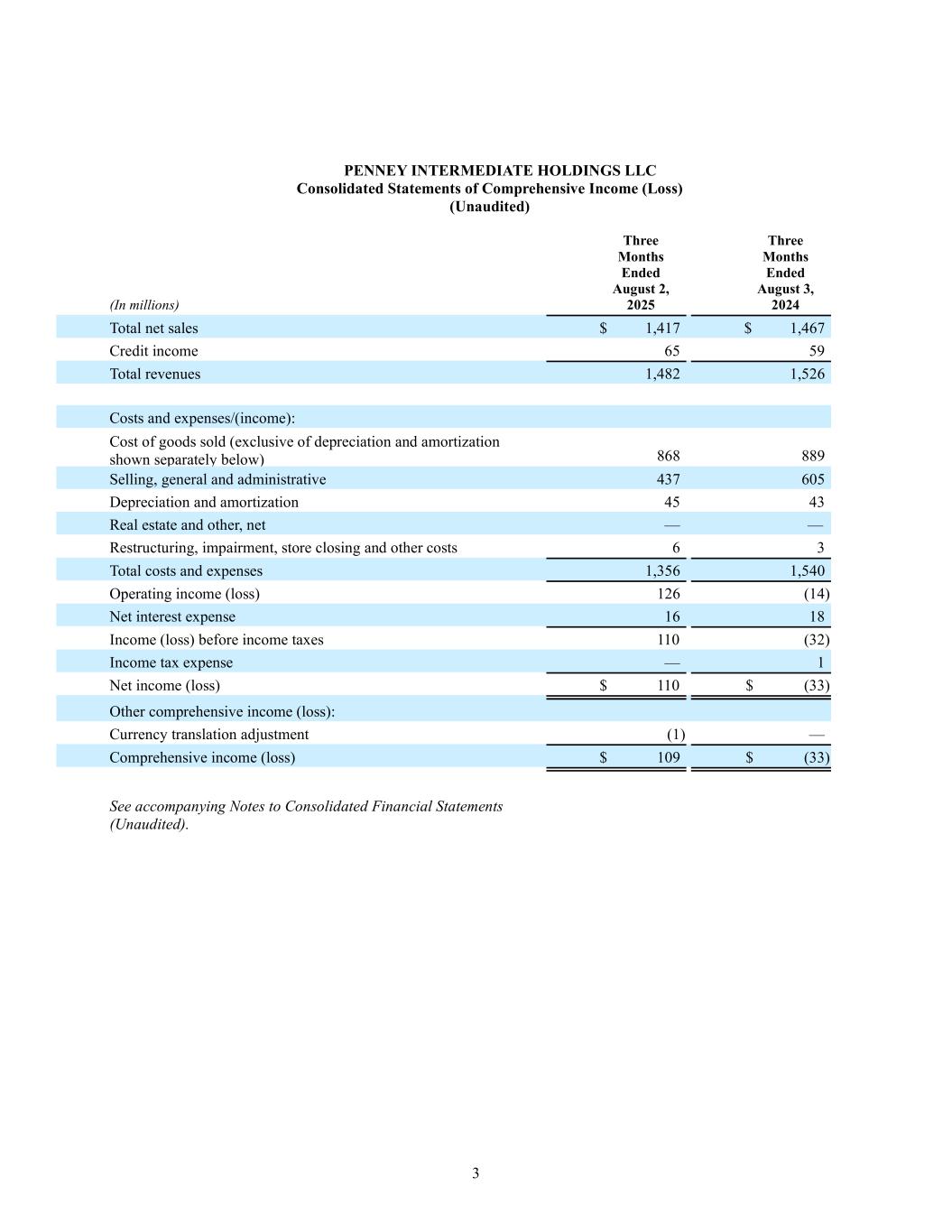

3 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Loss) (Unaudited) (In millions) Three Months Ended August 2, 2025 Three Months Ended August 3, 2024 Total net sales $ 1,417 $ 1,467 Credit income 65 59 Total revenues 1,482 1,526 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 868 889 Selling, general and administrative 437 605 Depreciation and amortization 45 43 Real estate and other, net — — Restructuring, impairment, store closing and other costs 6 3 Total costs and expenses 1,356 1,540 Operating income (loss) 126 (14) Net interest expense 16 18 Income (loss) before income taxes 110 (32) Income tax expense — 1 Net income (loss) $ 110 $ (33) Other comprehensive income (loss): Currency translation adjustment (1) — Comprehensive income (loss) $ 109 $ (33) See accompanying Notes to Consolidated Financial Statements (Unaudited).

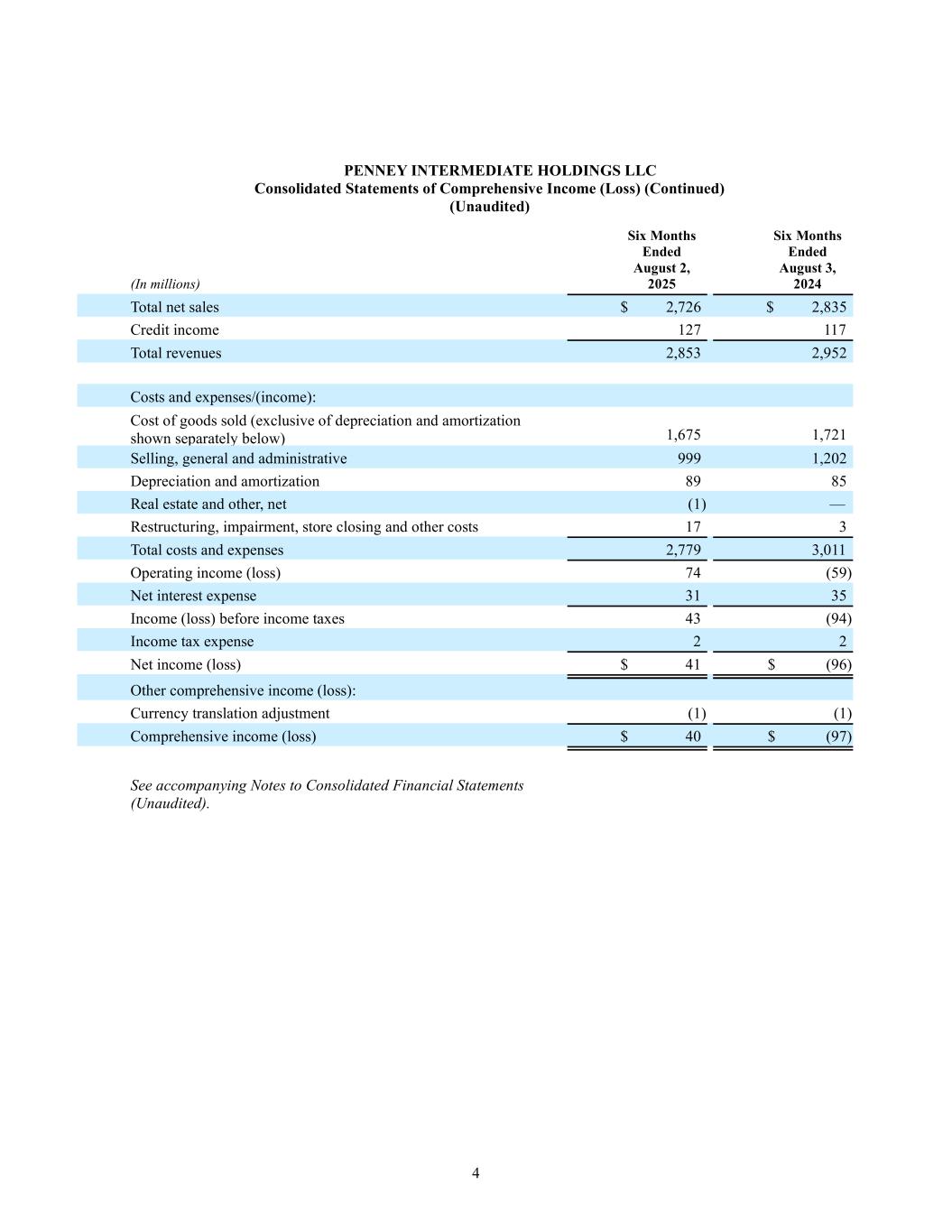

4 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Loss) (Continued) (Unaudited) (In millions) Six Months Ended August 2, 2025 Six Months Ended August 3, 2024 Total net sales $ 2,726 $ 2,835 Credit income 127 117 Total revenues 2,853 2,952 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 1,675 1,721 Selling, general and administrative 999 1,202 Depreciation and amortization 89 85 Real estate and other, net (1) — Restructuring, impairment, store closing and other costs 17 3 Total costs and expenses 2,779 3,011 Operating income (loss) 74 (59) Net interest expense 31 35 Income (loss) before income taxes 43 (94) Income tax expense 2 2 Net income (loss) $ 41 $ (96) Other comprehensive income (loss): Currency translation adjustment (1) (1) Comprehensive income (loss) $ 40 $ (97) See accompanying Notes to Consolidated Financial Statements (Unaudited).

5 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Balance Sheets (Unaudited) (In millions) August 2, 2025 August 3, 2024 Assets Current assets: Cash and cash equivalents $ 236 $ 252 Merchandise inventory 1,624 1,743 Prepaid expenses and other assets 312 173 Total current assets 2,172 2,168 Property and equipment, net 1,181 1,200 Operating lease assets 1,681 1,706 Financing lease assets 95 74 Other assets 131 137 Total assets $ 5,260 $ 5,285 Liabilities and member’s equity Current liabilities: Merchandise accounts payable $ 554 $ 534 Other accounts payable and accrued expenses 456 450 Current operating lease liabilities 86 76 Current financing lease liabilities 3 4 Current portion of long-term debt, net 9 9 Total current liabilities 1,108 1,073 Noncurrent operating lease liabilities 1,855 1,888 Noncurrent financing lease liabilities 104 83 Long-term debt 466 473 Other liabilities 104 101 Total liabilities 3,637 3,618 Member’s equity Member’s contributions 300 300 Accumulated other comprehensive loss (8) (6) Reinvested earnings 1,331 1,373 Total member’s equity 1,623 1,667 Total liabilities and member’s equity $ 5,260 $ 5,285 See accompanying Notes to Consolidated Financial Statements (Unaudited).

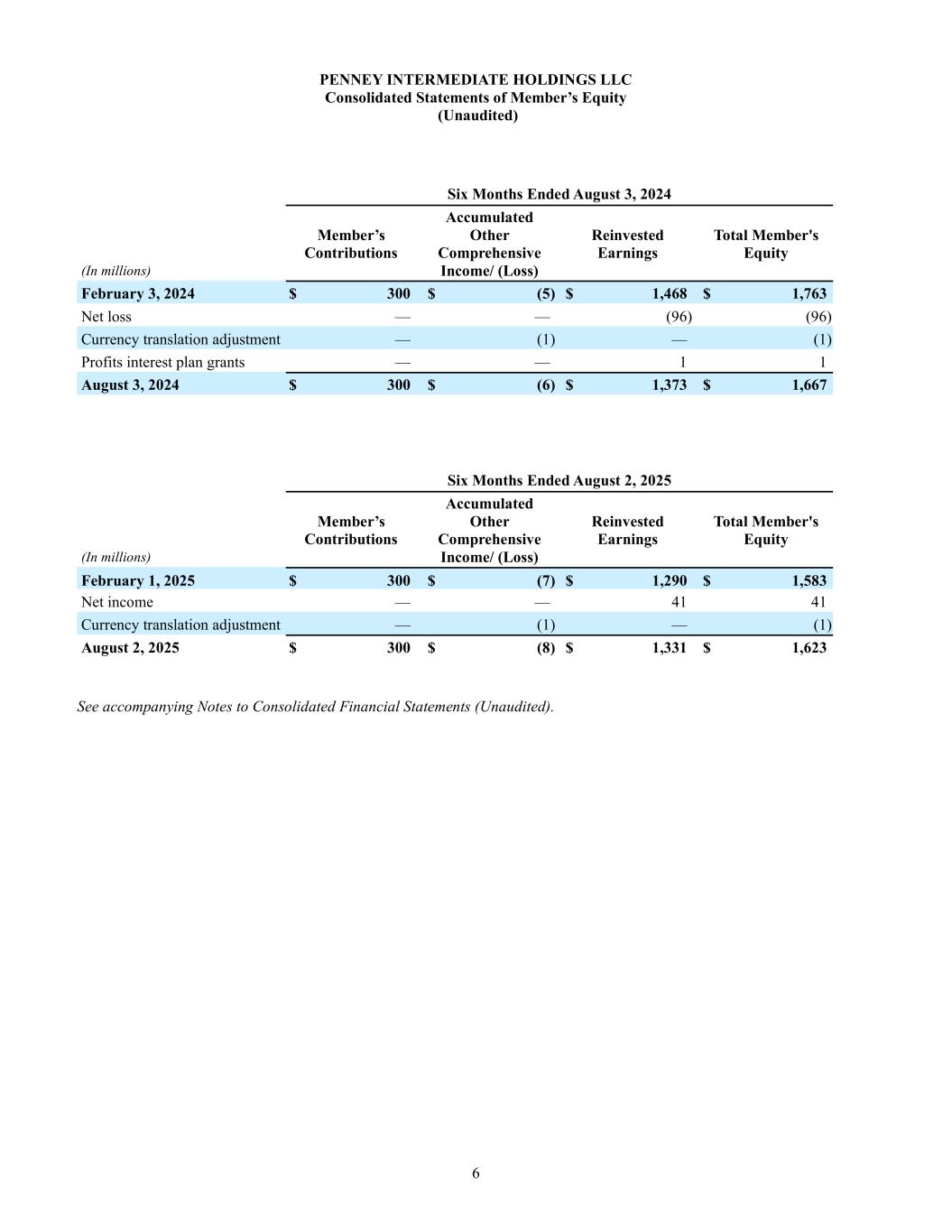

6 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Member’s Equity (Unaudited) Six Months Ended August 3, 2024 (In millions) Member’s Contributions Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity February 3, 2024 $ 300 $ (5) $ 1,468 $ 1,763 Net loss — — (96) (96) Currency translation adjustment — (1) — (1) Profits interest plan grants — — 1 1 August 3, 2024 $ 300 $ (6) $ 1,373 $ 1,667 Six Months Ended August 2, 2025 (In millions) Member’s Contributions Accumulated Other Comprehensive Income/ (Loss) Reinvested Earnings Total Member's Equity February 1, 2025 $ 300 $ (7) $ 1,290 $ 1,583 Net income — — 41 41 Currency translation adjustment — (1) — (1) August 2, 2025 $ 300 $ (8) $ 1,331 $ 1,623 See accompanying Notes to Consolidated Financial Statements (Unaudited).

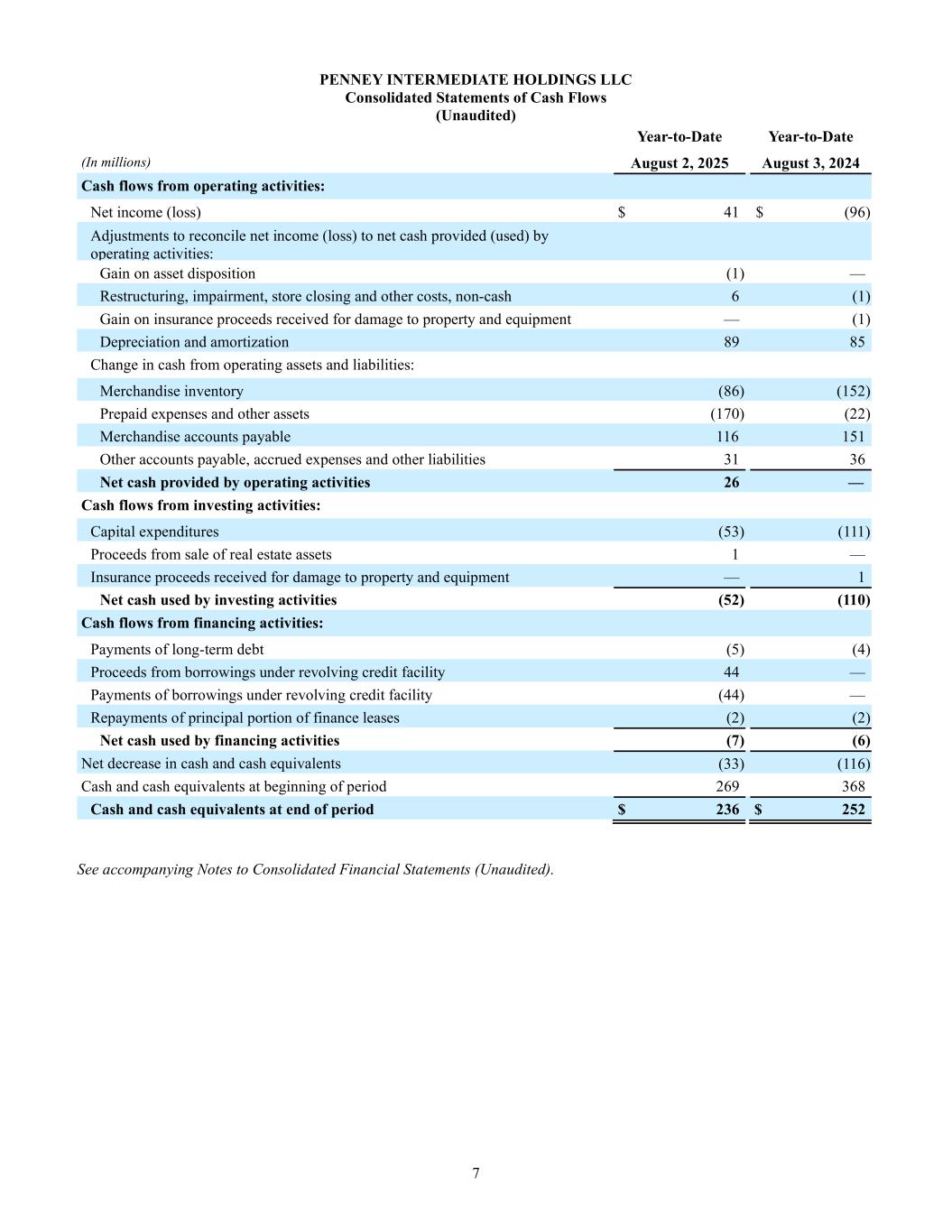

7 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Cash Flows (Unaudited) Year-to-Date Year-to-Date (In millions) August 2, 2025 August 3, 2024 Cash flows from operating activities: Net income (loss) $ 41 $ (96) Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: Gain on asset disposition (1) — Restructuring, impairment, store closing and other costs, non-cash 6 (1) Gain on insurance proceeds received for damage to property and equipment — (1) Depreciation and amortization 89 85 Change in cash from operating assets and liabilities: Merchandise inventory (86) (152) Prepaid expenses and other assets (170) (22) Merchandise accounts payable 116 151 Other accounts payable, accrued expenses and other liabilities 31 36 Net cash provided by operating activities 26 — Cash flows from investing activities: Capital expenditures (53) (111) Proceeds from sale of real estate assets 1 — Insurance proceeds received for damage to property and equipment — 1 Net cash used by investing activities (52) (110) Cash flows from financing activities: Payments of long-term debt (5) (4) Proceeds from borrowings under revolving credit facility 44 — Payments of borrowings under revolving credit facility (44) — Repayments of principal portion of finance leases (2) (2) Net cash used by financing activities (7) (6) Net decrease in cash and cash equivalents (33) (116) Cash and cash equivalents at beginning of period 269 368 Cash and cash equivalents at end of period $ 236 $ 252 See accompanying Notes to Consolidated Financial Statements (Unaudited).

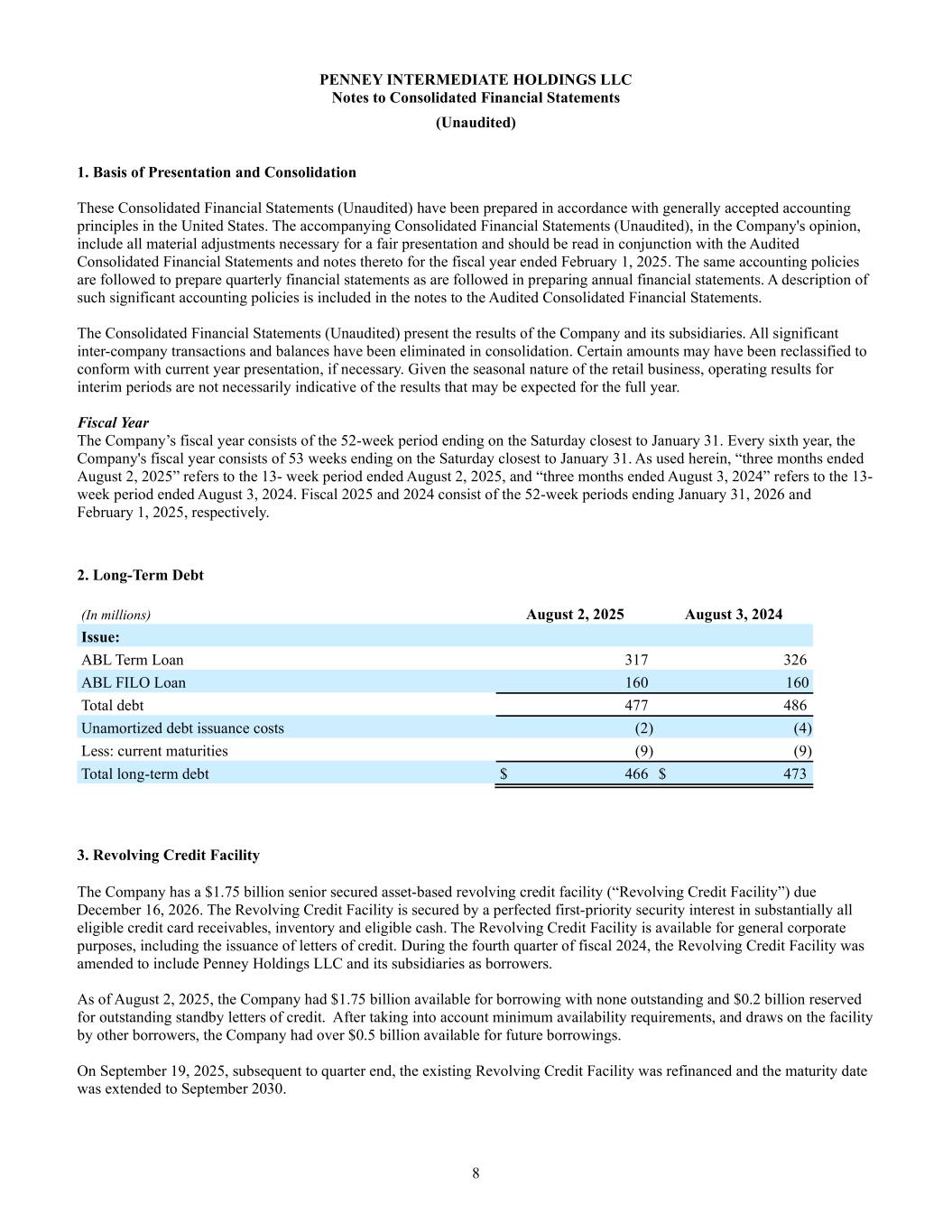

8 PENNEY INTERMEDIATE HOLDINGS LLC Notes to Consolidated Financial Statements (Unaudited) 1. Basis of Presentation and Consolidation These Consolidated Financial Statements (Unaudited) have been prepared in accordance with generally accepted accounting principles in the United States. The accompanying Consolidated Financial Statements (Unaudited), in the Company's opinion, include all material adjustments necessary for a fair presentation and should be read in conjunction with the Audited Consolidated Financial Statements and notes thereto for the fiscal year ended February 1, 2025. The same accounting policies are followed to prepare quarterly financial statements as are followed in preparing annual financial statements. A description of such significant accounting policies is included in the notes to the Audited Consolidated Financial Statements. The Consolidated Financial Statements (Unaudited) present the results of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation. Certain amounts may have been reclassified to conform with current year presentation, if necessary. Given the seasonal nature of the retail business, operating results for interim periods are not necessarily indicative of the results that may be expected for the full year. Fiscal Year The Company’s fiscal year consists of the 52-week period ending on the Saturday closest to January 31. Every sixth year, the Company's fiscal year consists of 53 weeks ending on the Saturday closest to January 31. As used herein, “three months ended August 2, 2025” refers to the 13- week period ended August 2, 2025, and “three months ended August 3, 2024” refers to the 13- week period ended August 3, 2024. Fiscal 2025 and 2024 consist of the 52-week periods ending January 31, 2026 and February 1, 2025, respectively. 2. Long-Term Debt (In millions) August 2, 2025 August 3, 2024 Issue: ABL Term Loan 317 326 ABL FILO Loan 160 160 Total debt 477 486 Unamortized debt issuance costs (2) (4) Less: current maturities (9) (9) Total long-term debt $ 466 $ 473 3. Revolving Credit Facility The Company has a $1.75 billion senior secured asset-based revolving credit facility (“Revolving Credit Facility”) due December 16, 2026. The Revolving Credit Facility is secured by a perfected first-priority security interest in substantially all eligible credit card receivables, inventory and eligible cash. The Revolving Credit Facility is available for general corporate purposes, including the issuance of letters of credit. During the fourth quarter of fiscal 2024, the Revolving Credit Facility was amended to include Penney Holdings LLC and its subsidiaries as borrowers. As of August 2, 2025, the Company had $1.75 billion available for borrowing with none outstanding and $0.2 billion reserved for outstanding standby letters of credit. After taking into account minimum availability requirements, and draws on the facility by other borrowers, the Company had over $0.5 billion available for future borrowings. On September 19, 2025, subsequent to quarter end, the existing Revolving Credit Facility was refinanced and the maturity date was extended to September 2030.

9 4. Litigation and Other Contingencies The Company is subject to various legal and governmental proceedings involving routine litigation incidental to its business. While no assurance can be given as to the ultimate outcome of these matters, the Company currently believes that the final resolution of these actions, individually or in the aggregate, will not have a material adverse effect on results of operations, financial position, liquidity or capital resources. 5. Subsequent Events The Company has evaluated subsequent events from the balance sheet date through September 19, 2025, the date at which the financial statements were available to be issued.

PENNEY INTERMEDIATE HOLDINGS LLC Statement of Consolidated Adjusted EBITDA For the Six Months Ended August 2, 2025 (In millions) Net income $ 41 Plus: Net interest expense 31 Income tax expense 2 Depreciation and amortization 89 Restructuring, impairment, store closing and other costs 17 Minus: Real estate and other, net (1) Consolidated adjusted EBITDA $ 179 Prepared in accordance with the definition of Consolidated Adjusted EBITDA per Section 1.1 of the Credit and Guaranty Agreement dated December 7, 2020.